Déjà Vu 2000

Stock markets ended 2023 on an up note after a surge in prices due largely to remarks of the Federal Reserve. In 54 days, the S&P 500 Composite gained 15% while nothing really changed in the real world. This past year reminds us of year-end 1999 when an almost identical wave of chasing markets occurred. (More about this later in the letter.) Exhibit 1 shows the investment returns of various popular market measurements for the year ending December 31, 2023.

What a Great Year …

It certainly was great if 2023 is the only year you ever invested. We like to remind people of the returns for the stock markets over the last two years. Notice in Exhibit 2 the returns for the S&P 500 Composite from December 27, 2021 to December 27, 2023. We often hear of the booming markets in 2023—but compared to what? If you compare the stock return versus the U.S. Treasury bill return for the same two-year period, the U.S. Treasury investment did better.

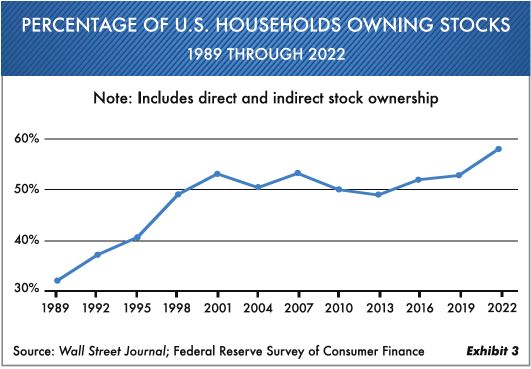

While the averages could and maybe will reach new highs in 2024, it doesn’t mean that all is well. Notice in Exhibit 3 that investors are more invested in stocks than at any time in the last 33 years. They are all in, not only personally but also in their 401(k) plans. No need to worry, as the Federal Reserve and Chairman Jerome Powell will always provide higher prices, just as they did the last weeks of 2023.

The Federal Reserve started this latest “buy everything” rally by throwing out rhetoric that was taken as “Lower rates are coming!” This message comes from a group of unelected people (mostly academics) who have singlehandedly ruined the normal economic system. Currently, sad to say, many of them are back to the old ways. A mere six weeks ago Chairman Powell was saying how we need to stay the course. Did anything really change? Perhaps it’s politics, or maybe the new Fed members are loose-money advocates. But this loose-money debt situation will eventually take its toll. Possibly not this year but eventually.

U.S. Federal debt is crossing over $34 trillion. Can you really grasp what a trillion dollars is? If you spent 1 million dollars every hour it would take 114 years to spend 1 trillion dollars! At the same time the U.S. spends less than 1 trillion dollars every year on food for the needy and on education for both primary and secondary schools. Thank you, Federal Reserve, for making sure that the middle class continues to dwindle. But what if rates stay higher for a while?

Never Happened Before

A number of time-proven, fundamental indicators are currently not signaling that the economy is ready to improve. These measurements have seldom been wrong in the past. First, the leading indicators have just shown 20 consecutive months of declines. This is the same string that started in 2007 to 2008. Second, two-thirds of all U.S. states are in economic contraction, according to the Federal Reserve of Philadelphia. Third, consumer confidence (present minus future) is negative and has been for some time, thus signaling that most consumers are not upbeat about the future. Fourth, the NFIB (National Federation of Independent Business) has never been this low without a recession occurring.

Could all these indicators be wrong this time? Yes, they could be, but you as an investor need to decide what level of risk you’re comfortable with given the present number of caution signs flashing.

Déjà Vu 2000

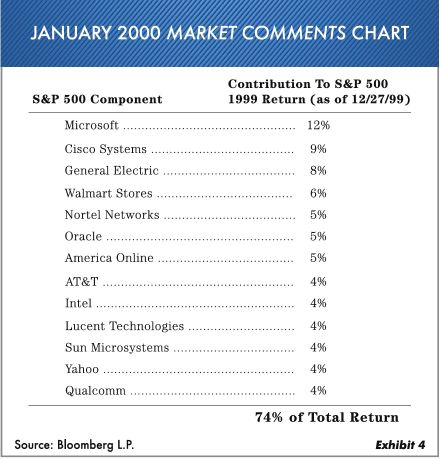

Our January 2000 Market Comments contained some very interesting numbers. The S&P 500 Composite was up +19.5%, and the NASDAQ was up +85% in 1999. According to Merrill Lynch, that year stocks with no earnings went up +52% and stocks with earnings went down -2%. Sound familiar? Exhibit 4 shows the exact text we printed 24 years ago.

Just a few facts relating to these 13 stocks from 2000 … Three or four of them either went bankrupt or technically bankrupt and had to merge. Only two stocks, Walmart and Oracle, eventually went down -35%, while the rest of the group declined -50% to -90%. A brutal 10-year period, to say the least!

That 1999 period was tough for all of us as Oxbow money managers because our analytics had us very lightly invested in stocks, but in retrospect it was the right call. From the year ending 1999 to the end of the first quarter 2000, the market made a small new high, but by that time hardly anyone believed anything bad could happen … much like today’s markets. Quotes from the January 2000 Market Comments include:

“People in today’s stock market are buying what is going up with no regard for value. As we go forward in the year 2000 the risks seem obvious to us but as yet no one seems to notice. A change in investment themes is probably starting but has yet to fully emerge.”

Three years later we got one of the best buying opportunities ever. During the 1999–2000 period some investors thought we had “lost it,” but in the aftermath it was correct. The NASDAQ lost almost -80% over that period. Do the math. It takes +500% to get even after that.

Which Leads to Today …

Today we have a similar version of the big-stock play of 2000. That would be the Magnificent Seven stocks—Microsoft, Amazon, Meta, Apple, Google (Alphabet), Nvidia and Tesla—are front and center, and nearly everyone owns them. In fact, this is the most concentrated market we’ve ever witnessed.

While markets never completely “rhyme,” they can be similar. Many of our key fundamental indicators, which have a record of seldom being wrong, presently point to tougher times ahead. Could they be wrong this time? Yes, anything can happen, but life and investing are a game of probabilities. When they add up to caution, it probably is best to listen up. Current 3-month to 6-month U.S. Treasury rates are 2% plus over the present rate of inflation. It is paying you to wait and see. You don’t have to follow the crowd, especially when protection is rule number one.

At Oxbow we are not out of the stock market. We have high cash reserves in U.S. Treasury bills, and these investment returns are doing well, plus they provide a high degree of safety. The investment game isn’t won in a single year. Your long-term goal should be to preserve buying power. That means drawdowns in value have to be limited. It would not surprise us to see something similar to first-quarter 2000 happen in first-quarter 2024 … So keep everything in perspective. On the income side, we’re also heavily invested in short-term U.S. Treasuries. Both our stock and income strategies are positioned for safety.

As we move into this new year, we at Oxbow expect continued market volatility. We assure you that we have the ability to stay flexible. And we wish you the very best in 2024!

Ted Oakley

Bob Walsh

A Tribute to Charlie Munger…We will miss his comments.

Know Thyself – “Always act within your circle of competence.”

Happiness – “You don’t have a lot of envy, you don’t have a lot of resentment, you stay cheerful in spite of your troubles, you deal with reliable people.”

Self-pity – “Whenever you think something or someone is ruining your life, it’s you. A victimization mentality is so debilitating.”

Resilience – “When it comes to adversity, you have to just soldier through.”

Envy – “The world is not driven by greed, it’s driven by envy.”

Inflation – “I predict our current politicians will not permit a new Volcker.”

Covid Response – “Capitalism works when able bodied young people feel agony if they refuse to work. It’s because of that agony that this whole economic system works.”

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.