‘Everything Is OK… or Is It?’

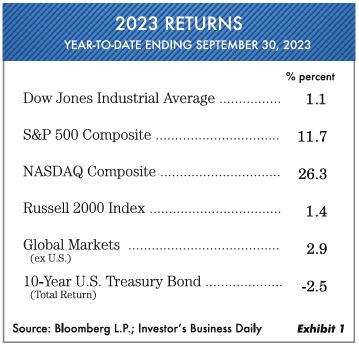

At least Wall Street would have you believe everything is OK. This is evidenced by most strategists who have decided that the stock market is ready to move forward. Even Federal Reserve chair Jerome Powell himself has said it. In Bloomberg’s July 26, 2023, report, Powell is quoted as saying, “The U.S. central bank’s staff economists are no longer forecasting a recession given recent resilience in the economic data.” It sounds good, but based on history, they are often wrong. In this letter we will address why we think things could be different. Exhibit 1 shows the investment returns of various popular market measurements for the first nine months of 2023.

It Could Be Different, But We Doubt It …

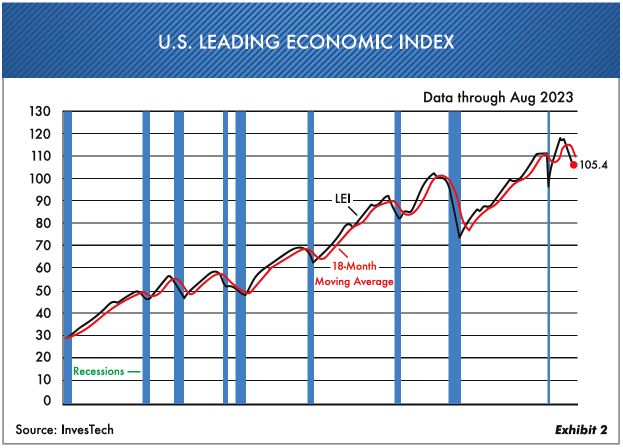

Economically, certain indicators are much better than others and have good track records. One of these is the Conference Board’s Leading Economic Index (LEI). It is widely recognized as one of the best indicators. It has been down for 17 months, the longest streak since the Great Financial Crisis of 2008–09. Exhibit 2 shows the LEI, with an impressive track record, since 1960.

Notice how when the index falls below the 18-month average the shaded portions show recession periods. Wall Street would have you believe that this time is different. But history tells otherwise. Until we see a change in the LEI, it will be hard for us at Oxbow to think we’re out of danger.

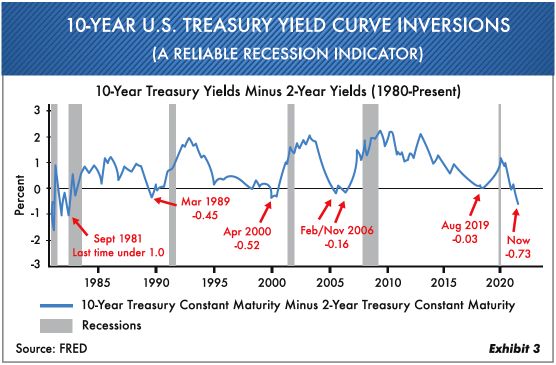

Another reliable indicator has been the inverted yield curve, where short-term interest rates are much higher than long-term interest rates. In Exhibit 3 the inversion periods are shown from 1980 to the present.

One thing to be aware of in this graph is the lag period between when the interest rates inverted and the recession began. Could both indicators be wrong at the same time? Maybe, but we doubt it. Until these two items look better, we maintain there still may be trouble ahead.

The Consumer Is in Good Shape

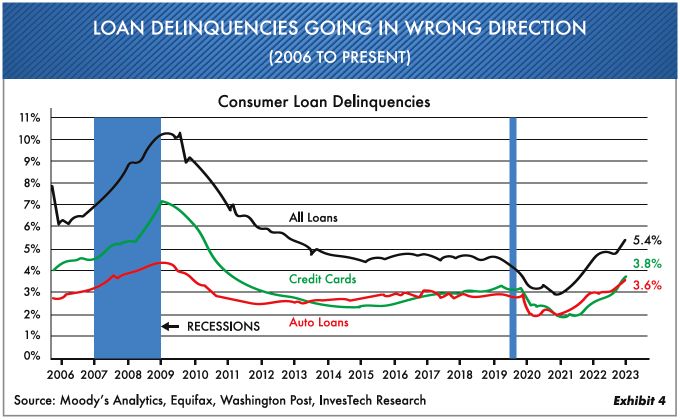

What? We at Oxbow find it interesting how most of the elite Wall Street strategists seem to think the consumer is in great shape. That said, the reason being they aren’t really in touch with the average consumer. How much time do you think they spend in mid- to lower America? Not much. In addition, most of the pundits who think the consumer is fine fail to realize that the current interest rate on consumer-credit-card debt has risen to 22% annually. In addition, a Bankrate survey earlier this year found 57% of adults can’t afford a $1,000 emergency expense. It certainly makes a person feel grateful that we are blessed. But notice Exhibit 4 showing consumer loan delinquencies. The rate of delinquent payments has risen the most in 10 years.

Competition for the Stock Market

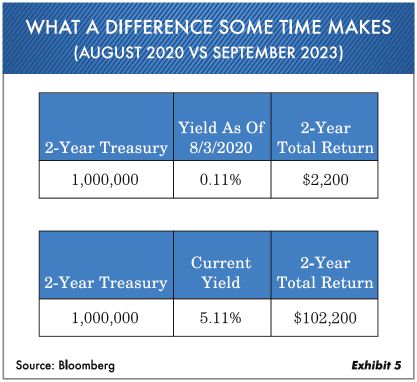

For many years during the so-called “free money” period, we heard the phrase TINA (there is no alternative) to owning stocks since interest rates were so unattractively low. That has all changed now, and TIAA (there is an alternative) in short-term bonds. Exhibit 5 shows the difference.

Think about the difference. You buy a two-year U.S. Treasury Note two years ago and see the dramatic difference in returns. This hasn’t happened in years, and investors are taking advantage of it. At Oxbow our largest investment position is the U.S. Floating Rate Treasury Note.

A Bull Market: Are You Sure?

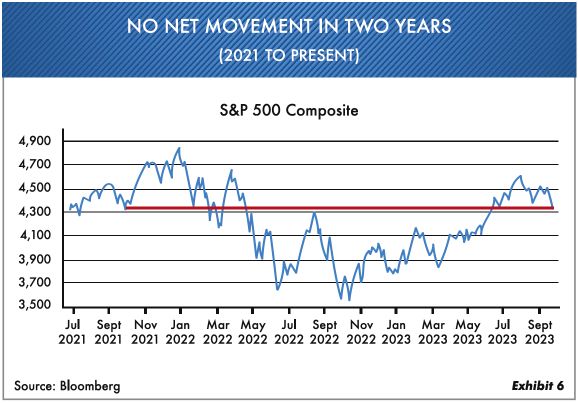

It’s interesting to observe how investors and the media tend to compartmentalize returns. All we hear about these days is the April to August 2023 rally in the market. But a closer look tells a different story. In Exhibit 6 the S&P 500 Composite index is exactly where it was two years ago. Not much of a bull market there.

In addition, the S&P 500 Composite is still -10.1% below its December 2021 high. The Nasdaq Composite is currently -18.5% below the high then. Investors have to remember this is a cycle, and the cycle isn’t over yet.

Where We Are Now …

At Oxbow we have maintained a defensive investment strategy for some time. Until we see some improvement in the aforementioned fundamentals, we feel it’s best to stay this way. We aren’t trying to be stubborn, but we have a responsibility, first and foremost, to preserve capital for investors.

If changes for the better do occur in key fundamentals, we’ll also change our present stance. There could be some outcomes that could affect investors more than presently expected. We should point out that many current investment advisors and investors have never been through elongated poor markets. Believe us, once you go through one, it leaves a lasting impression upon you.

As we enter into Fall, we wish you all the best in the upcoming November and December holidays.

Ted Oakley

Bob Walsh

“If you put the federal government in charge of the Sahara Desert, in five years there would be a shortage of sand.”

-Milton Friedman-

“Positive thinking will let you do everything better than negative thinking will.”

–Zig Ziglar-

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.

GET YOUR COMPLIMENTARY COPY OF TED OAKLEY’S BOOK

Your Money Mentality

Order Below