Spend, Spend, Spend

We are going through a unique and challenging time to be an investor. Stock markets are high, consumer borrowing is extremely high, government debt is soaring, and inflation is still a problem. This makes one wonder what is really going on here? We will delve into some of these topics in order to keep investors up to date on the real world as we see it. Exhibit 1 shows the investment returns of various popular market measurements for the first quarter ending March 31, 2024.

Concentration …

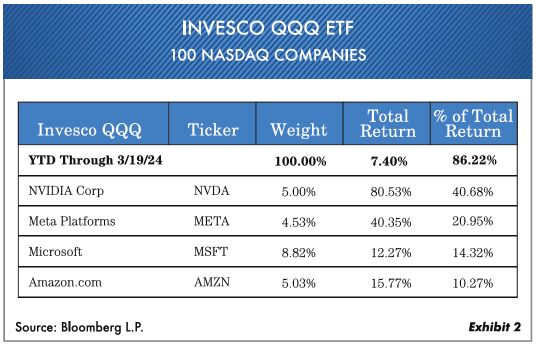

In our investing history we have never seen such a concentration of holdings in so few stocks. The average investor tends to look at only the Dow Jones Industrial Average or the S&P 500 Composite and assumes these are the average stocks. More telling in today’s stock market but less popular, is the Invesco QQQ ETF which represents 100 of the most innovative NASDAQ companies. Notice in Exhibit 2 that four stocks made up 86% of the return in this measurement, while two stocks alone comprised 62% of the QQQ ETF’s total return. Two stocks! Is that risky enough for you?

At Oxbow we own many stocks, but we are not locked in to over-owning these particular overpriced issues. Later in this report we will show some of the areas we especially like now. It isn’t all bad, but you have to know value as opposed to overpriced areas. Great investors know which areas offer the best risk/reward.

Runaway Spending

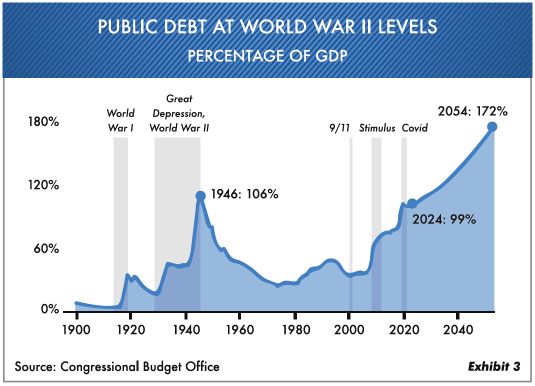

It is quite apparent that the U.S. government is on a one-way ticket to big problems with its huge debt load. In 2023 the U.S. government was responsible for spending that was 23% of GDP (gross domestic product.) They dreamed up every possible way to get money into the economic system. In addition, they had no conscience when it came to strapping future generations with debt. The increase in government debt and government deficits go hand in hand with increased economic activity.

Carpe diem, live for today, seems to be the current motto in Washington. Notice Exhibit 3 showing debt as a percentage of GDP. Sad to say, we are as deep in debt now as we were at the end of World War II. Governmental estimates project that the national debt could rise to 172% of GDP by 2054.

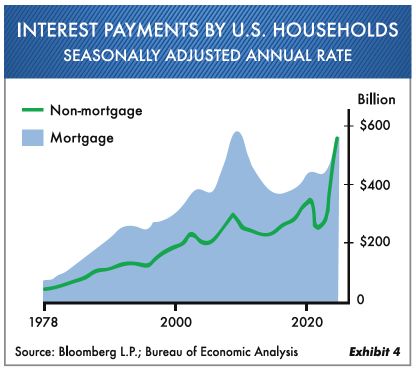

On top of that, consumers currently are using existing debt freely. At Oxbow we believe that the average consumer thinks the government will always bail them out during tough times. Think 2008, 2009, 2010, 2020 and 2021 all examples of this. Notice Exhibit 4, which traces the rising trend of interest payments of households going back to 1978. Unfortunately, for the first time in history, households are paying as much interest on their non-mortgage debt (credit cards; motor vehicles; buy-now, pay-later items) as they do on their mortgage payments.

The Federal Reserve

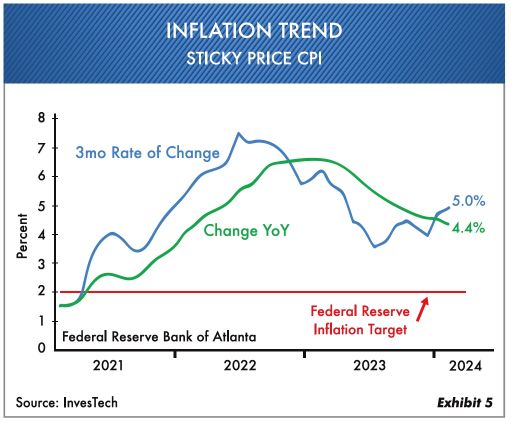

This is the worst case of ineptitude. With more than 400 Ph.D. economists, they decide to throw Wall Street a lifeline by talking about lowering interest rates. Look at these facts … U.S. unemployment is at a low of 3.9%. The U.S. government is running a $1.8 trillion deficit, which normally would be in effect if the economy was weak. But here we are—the strongest economy in the world right now. On top of that the inflation rate currently is not working for them. The Fed’s stated inflation target is 2%, but notice it is now at 5% as shown in Exhibit 5. Makes you wonder what these people are thinking. Lowering interest rates in present economic conditions may work in the short run, but in the long run we believe inflation will move higher once again!

Where Does All This Leave Us as Investors?

First, let’s take a look at the bond market. Our Oxbow portfolios are still, to a large degree, in short-term U.S. Treasuries, which includes 3-month to 2-year maturities. Why not … as we believe that the Fed may be backed into a corner and not lower rates as much as Wall Street thinks. Currently we are receiving approximately 5.3% on the floating-rate U.S. Treasury.

If the Fed funds rate is now 5.5% and they lower the rate 0.25% three times (as they say … who knows?) the rate is still 4.75%. Taking duration risk by buying longer-term bonds does not seem appropriate. High yield and corporate bonds do not offer enough extra return for the risk involved.

In our Oxbow high-income strategy, we own pipelines, such as Enterprise Products, MPLX and Energy Transfer, with yields of 7.1% to 8.2%. In addition, we have preferred stocks with 6.5% yields, and now even some foreign bonds are attractive.

In our equity-managed portfolios, we have made some strategic shifts toward cheaper consumer stocks (Coca-Cola, Unilever) in the last six months. Also, healthcare areas such as Johnson & Johnson, as well as Centene Corporation. Energy has taken a front seat for us, with additions in the last six months, of EOG Resources, ExxonMobil and Williams Companies Inc.

All three of our investment strategies currently hold an average of 50% in the U.S. Treasury allocation. The overall stock market does not currently appear to be cheap, so we have to have a safety backup. The rest of this year could be tricky for investors. If we do get a significant market setback, we would add more equity.

Historically, election years can be unusual, and ongoing problems in the Middle East only add to the uncertainty. Headline news is likely to play a part in investment sentiment. If we do get a significant market setback, we will add more to equity exposure. If not, Oxbow managed portfolios are positioned to generally stay “as is.”

As always, we at Oxbow Advisors maintain our longstanding, disciplined investment approach to buy and hold stocks and bonds that we believe have true value. If you have not watched the recent video by Chance Finucane, our Chief Investment Officer, we encourage you to do so.

We wish you well … and hope you have an enjoyable spring and summer.

Ted Oakley

Bob Walsh

“I’ve never seen luck jump on a guy sitting in the shade.”

-Darrell Royal

“Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time.”

-Thomas A. Edison

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.