Doing ‘The Hokey Pokey’

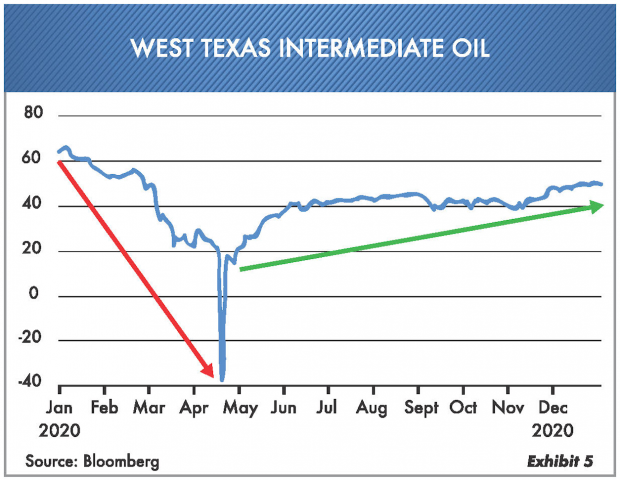

After coming off the greatest rebound in stock market history, just about every investor seems to be back on top again. From the depths of despair in late March 2020 to the high on the mountaintop in December 2020, the investment environment on Wall Street is … full steam ahead. As you can see in Exhibit 1 all stock market averages were up last year. Some more than others, but obviously the NASDAQ Composite led the pack, because that’s where the highflyers were.

One dominant observation: Practically every investor is doing the same thing … same stocks, same indexes, same allocation. Hence the name of the old song, “The Hokey Pokey,” which implies that everyone is doing the same thing all at the same time. This brings to mind some other times in history when investors were also doing the same thing.

For example, in the early 1980s investors bought every small oil and gas stock that traded. Then in 1990 they bought full force into Japan (the NIKKEI Index is still -30% below its January 1990 level). In 1999–2000 tech stocks were all the rage. In our January 2000 Market Comments, with the NASDAQ up some 85%, we said investor mood was that there was no end in sight. (What happened? The NASDAQ market fell -77% into October 2002.) Then there was the housing and condo craze of 2006–07, an era of so-called free money and risky mortgages. Once again, virtually everyone was doing the same thing.

Let’s emphasize straight away that we at Oxbow Advisors own stocks in both growth and dividend varieties. But our managed portfolios are balanced with some cash and other income vehicles as well. It’s imperative to maintain balance, and that means also having some liquidity.

The Public Is Back …

Here are several examples of what we’ve witnessed over the last few months.

A 15-year-old high school sophomore trading stocks and enjoying it.

No fewer than six people we know of who now day-trade instead of working at a “real” job.

A set of home movers who trade on Robinhood.

Three college students who trade stocks between studies.

Last but not least, an inquiry by a nephew who is in real estate that maybe he should use all his funds to buy NIO Inc., an electric car maker with no profit.

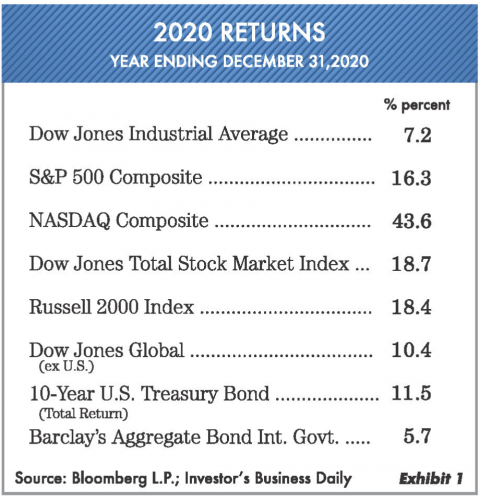

To get a better feel for all this, look at Exhibit 2 showing the number of yearly IPOs since 2000; 2020 was a record year.

When you are buying into first-time public companies, you’re likely buying more speculative companies. At this point, the public is all over these investments! It doesn’t matter if the company makes or loses money. Last year a total of 480 IPOs in the U.S. raised over $150 billion. Many of them made no money and, in fact, lost money. DoorDash (DASH) went public and rose 86% on the first day of trading. Airbnb (ABNB) also went public and skyrocketed to 113% the first day. Neither of these two companies to date have made a profit. (In contrast, we at Oxbow buy stocks that are making money and have prospects of even higher earnings over the next five years.) We don’t speculate in stocks with no earnings and no revenue. In our world, that is not investing!

Finally, there were 248 SPACs (special purpose acquisition companies) that came to the public market in 2020. They are the epitome of Wall Street selling at its best. These are blank-check companies that will buy something (maybe) for investors. To do so, the investor gives up 20% to the starting group, which has very little money in the deal. Best advice on these … stay away!

Bonds, Bonds: Where to from Here …?

As most of our investors at Oxbow know, we have been a large buyer of bonds over the last 15 years, with maturities ranging from one year to 20 years. This has proven to be good for our investors. With the Federal Reserve now buying almost everything in sight, it has made bonds a tough trade. Exhibit 3 shows the effects of inflation on current bond prices.

This is the problem within the current investment environment … If you are receiving less than 1% in interest on a 10-year U.S. Treasury bond and the inflation rate (CPI) is 1.6%, you are losing ground and your buying power is eroding. The so-called “Financial Planners and Wealth Advisors” still continue their ongoing party line of just buy the bond funds. The problem with this is that new purchases of bonds carry more risk with little return. The average age of portfolio managers in the U.S. is 49, and they have never seen rising interest rates. At Oxbow we have all ages of money managers, ranging from 30 to 70 years. A few, including Ted Oakley, Bob Walsh, Rusty Pierce and Dana Croswhite, have seen inflation trend higher. We are preparing to combat potential rising inflation by currently adding positions in U.S. Treasury inflation bonds (TIPs as they’re called). We’re also starting to add some other income items, including high-yielding preferred stocks and a limited number of foreign investments, to our bond portfolios. The reason is that those items are less risky than some bonds. In addition, it’s the only place to get a real return. This brings up the following question …

If Inflation Is Returning, What About Commodities?

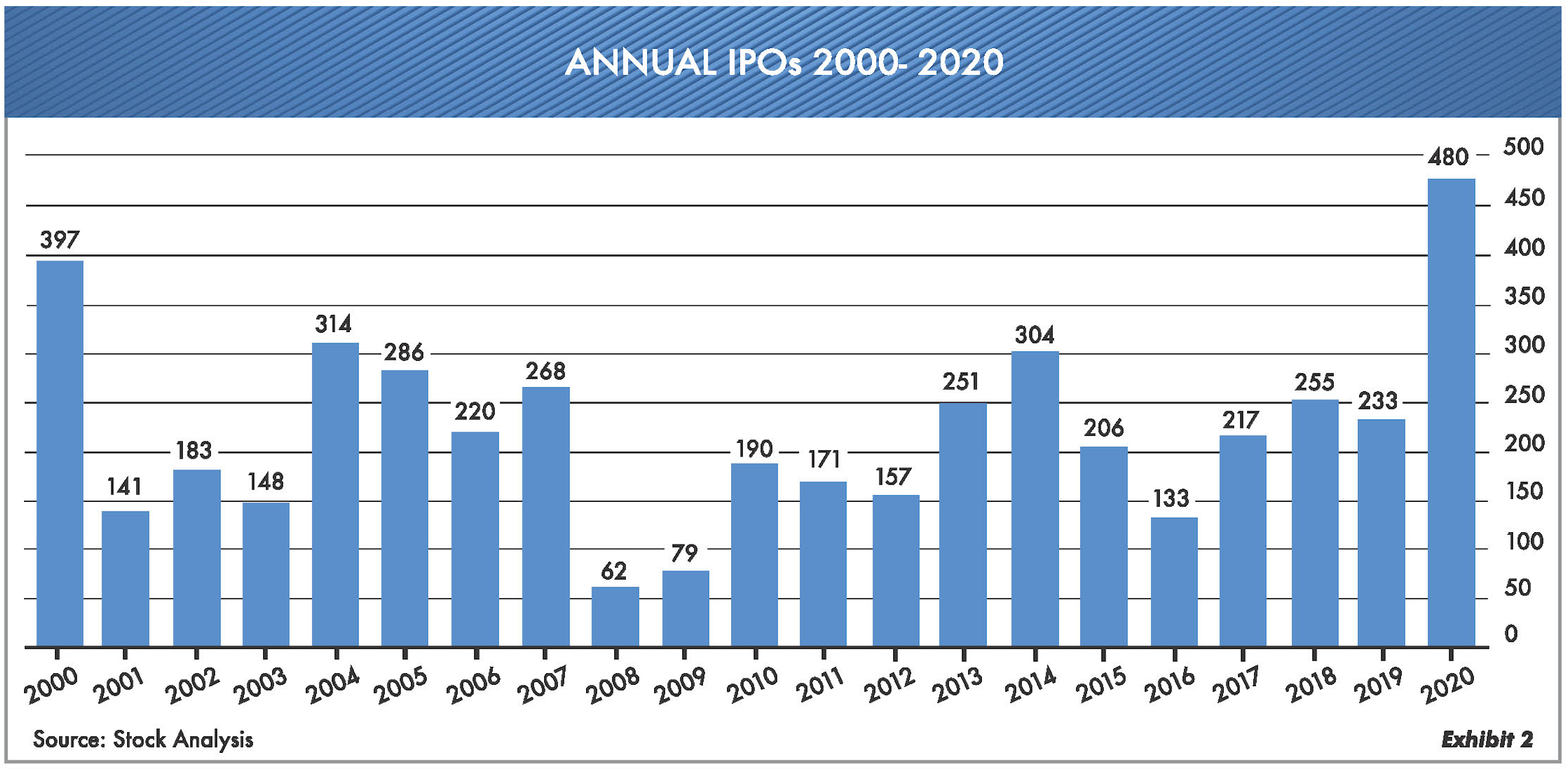

It has been a long time since commodities have performed well. In fact, it has been so long that most investors have written them off for good. We can understand people wanting to get on the “green bandwagon,” and we also appreciate the need to take care of our country’s resources. Nevertheless, commodities consist of many products used in everyday life. Notice Exhibit 4 shows the ratio of commodity prices to the stock market prices since 1970.

Maybe it’s time for a change? Our friend Bart Starr Jr. of McVean Trading & Investments Inc. runs commodity accounts. We discussed that the odds are quite high for better returns in commodity prices. This would go hand in hand with the trend of somewhat higher interest rates. (This is an area, from an investment standpoint, we will be pursuing this new year.) Commodities that fall into this category include timber, oil, grains, metals, food and materials. Currently on Wall Street there’s a major standoff between people who think inflation (commodities) is returning and those who think disinflation is here for a long time.

We Didn’t See This One Coming …

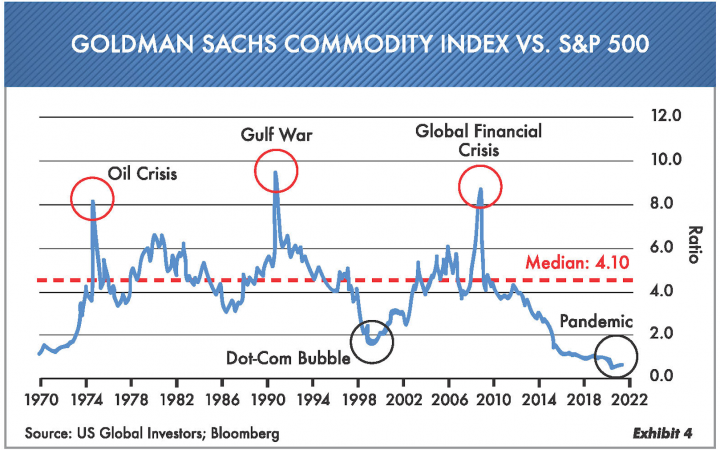

Looking back, as we entered 2020 the price per barrel of crude oil was $60, but still well below the 2013–14 price of $100. In the Oxbow stock accounts, we had no exposure to oil and gas, but in high-income-oriented portfolios we did own some select gas-pipeline companies due to their high-yielding cash flow. When the pandemic hit, it was like a natural disaster. As those who have been through major hurricanes, we can tell you firsthand that everything stops. For a while in 2020 everything, including travel, nearly stopped. Notice Exhibit 5 shows crude oil prices going from $60 to zero and below.