Download Market Comments Document Here

You Can’t Have It Both Ways

The well-defined upward trend of the stock market remained intact from the opening bell in January 2017 through the end of last year. Looking back to early 2017, Birinyi Associates (an investment research firm) reported that a sample group of 18 Wall Street strategists expected that the S&P 500 Composite would rise 5.5% for 2017. Instead, the year ending December 31, 2017, finished exceptionally strong with sizable, double-digit returns recorded by almost all major market measurements, as shown in Exhibit 1.

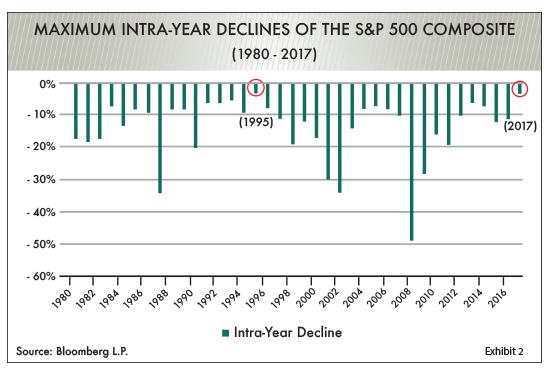

Interestingly, the popular Dow Jones Industrial Average notched the greatest number of closing daily highs ever recorded in one year. Many significant changes occurred during the past 12 months … i.e., a new president was elected, tax legislation was passed, Bitcoin hit the mainstream, global geopolitical pressures intensified, and numerous harassment scandals made front-page news. Even with all that, the markets encountered very little volatility. This is graphically shown in Exhibit 2, which traces maximum intra-year declines for the past 37 years—from 1980 through 2017.

As shown, 2017 had the smallest intra-year decline in 22 years of only -3%. Usually during a “normal year,” the stock market declines on average -10% or more at some point. Last year was unquestionably an outlier. In fact, there has been only one other year (1995) since 1980 when volatility was that low!

In reality, we suspect that the banner market returns in 2017 probably did borrow a lot from potential gains of this new year.

Since early 2009 when the bull market began, investors have increasingly become accustomed to expecting a steadily rising stock market almost every month and year. In so doing, most of them appear to have forgotten the risks that historically occur. Meanwhile, nearly everyone seems to believe that this whole investment process is somehow linear. Which brings us to this …

Investor – Know Thyself

The title of this Market Comments, “You Can’t Have It Both Ways,” refers to investor reactions in both extreme down and extreme up stock market environments. Over our many years of investing, we repeatedly observe that a large number of investors tend to shift their strategy stance based on their most recent market experience. The latest 18-month market advance is heavily influencing how people feel about risk. This also noticeably occurred at the market low in 2008–09 when Oxbow had a few stock investors who were almost completely averse to taking risk after the market fell. They wanted growth but also wanted low volatility and safety. It doesn’t work that way.

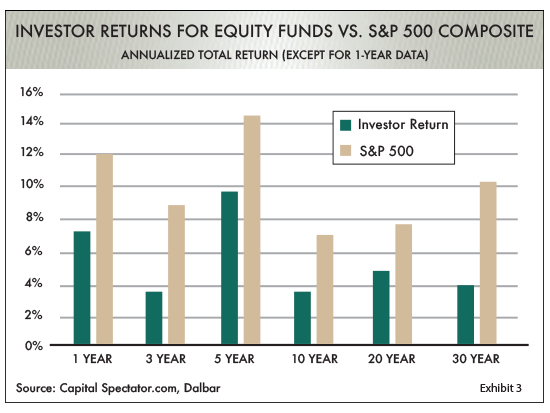

Our concern is that some investors who are generally conservative and risk-averse now want to participate in the stock market, as they have finally become caught up in the bull-market rally. The message is loud and clear: You can have one or the other but not both. Exhibit 3 shows Investor Returns vs. the broadly based S&P 500 Composite.

As shown, there is a striking difference between what investors experienced and what market returns really were over 30-year periods. The average investor realized a return of 4%, while the S&P 500 Composite was up 10%.

Most of this happens because many investors tend to change strategies at precisely the wrong time.

In the money-management business, we spend as much time on what we call the “Double E”…Emotions and Expectations, as we do anything else. Warren Buffett says, “It is temperament not intellect that counts the most.” This is so true! As an example in the year 2000, Fortune magazine featured an article titled “10 Stocks to Last the Decade.” They are listed in Exhibit 4.

At the early-2000 market peak, spirits were high and the vast majority of investors willingly wanted to take on more risk, or so they thought.

Virtually no one at that time was managing risk, and nearly everyone was euphoric and thought the sky was the limit. Looking back—without the big gain of Genentech—returns of this list of stocks were dismal. The conclusion of all this? Make sure you understand your own risk profile. The ability to really know yourself is critical when making investment decisions.

Oil and the Dollar

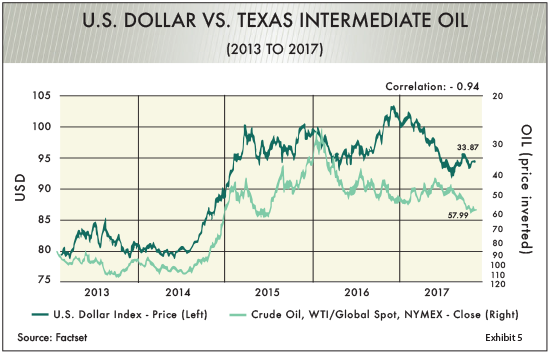

At the beginning of 2017, we at Oxbow both verbally and in writing stated our expectations that the dollar price would be weak. This was a contrary opinion, as most investors thought just the opposite. In fact, a lower dollar (DXY) trend turned out to be the case last year as it posted its largest yearly percentage drop in a decade of almost -10%. In Exhibit 5, notice the correlation of the movement in the price of the U.S. dollar and the inverted price of West Texas Intermediate Oil. The comparison is not perfect, but it does seem to relate, as these two variables over time generally tend to follow an established pattern.

With European and other foreign markets currently gaining economic vitality and the U.S. in a late stage of its bull market, we believe that the weakness in the dollar will continue into 2018. Historically, a declining dollar trend doesn’t always lead to higher oil prices, but presently this may be the case. Accordingly, Oxbow-managed portfolios have positions in energy stocks, as well as energy MLPs (master limited partnerships), that should do well if the dollar does decline further.

The shift to higher oil-related stock prices may be slow to develop, but we feel it will occur sometime in 2018.

One More Time – Interest Rates

Short-term interest rates moved higher in 2017, while the yields on the 20-year and 30-year bonds did not go up. The Federal Reserve has publicly announced its intention this year to further raise short-term interest rates. Currently, the difference between the yield on the five-year U.S. Treasury and the 30-year U.S. Treasury is a mere 0.53%, which is almost flat. This will turn into a concern if the yields cross over each other and become inverted. This could signal a future economic recession.

Dr. Lacy Hunt (Executive V.P. and Chief Economist of Hoisington Investment Management Company), in a December 28, 2017 interview stated that tax cuts, infrastructure legislation changes, and other measures enacted by Congress will not provide a boost to the economy if they are funded with increases in debt. That’s where we are now!

Our various Oxbow Advisor investment strategies accomplished what they were designed to do last year. Even with approximately 20–25% cash positions, they performed favorably. What do we expect for 2018? Volatility is likely to return, and there will probably be more unexpected surprises. We believe that the stock market will move somewhat higher again this year but fall short of the extreme returns that were achieved in 2017. The possibility of a recession developing, due to ill-timed moves by the Federal Reserve, cannot be ruled out in the second half of 2018.

In Summary

At this mature stage of the market cycle an increasing number of investors are tending to make changes they would not normally make. They may have regrets that they missed a move. If you have those feelings, just be patient for a time. The old adage, “Just give me 10% with no risk,” starts to feel like it’s real, but know that it’s not. We go back to our title, “You Can’t Have It Both Ways.”

For Oxbow, finding fundamentally strong businesses at a discounted price has become an increasingly difficult task. As always, liquidity and preservation of capital are main components of our investment process. When there is little “good value,” we would rather wait. Rest assured, stock prices will become discounted again at some point. At Oxbow we intend to remain defensive in 2018. Corrections are not all bad as we will use those times for additions.

As 2018 begins, we at Oxbow wish you a healthy and prosperous new year.

Ted Oakley

Bob Walsh