Business as Usual … Really?

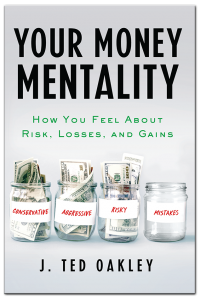

The investment environment for the first nine months of 2022 has been one of the most tumultuous periods on record. So far this year, almost all asset classes are negative. It looks more and more like a “soft-landing economy” is not going to happen. This is why investors need to turn their attention to recession instead of just inflation. We hope to shed some light on where we believe the dangers still exist and why we continue to maintain a defensive investment posture. Returns for various popular market measurements for the nine months ending September 30, 2022, are shown in Exhibit 1.

Interest Rates … Thank You, Federal Reserve

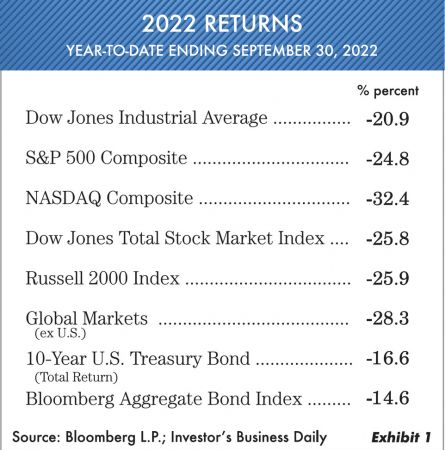

As we have said for a number of years now … the Federal Reserve’s approach to monetary policy has, on balance, done harm to the U.S. central bank position as many missteps have been made. For this year alone the Fed chairman after raising interest rates, commented on September 21, “No one knows whether the process will lead to recession or, if so, how significant that recession will be.” In addition, Janet Yellen, the U.S. Treasury chief, said on September 27, “I don’t see any erratic financial condition.” At Oxbow we would say heads of the Fed and the U.S. Treasury are both largely clueless, and their credibility is questionable. As an example, Exhibit 2 shows the Bloomberg U.S. Treasury bond index going back to 1974. This year is one of its worst years ever.

Over the last 45 years there have been only five years of negative returns. The all-time-record decline was in 1931 when treasury bonds fell -15%. Higher interest rates are here. This historically leads to … higher prime lending costs, higher borrowing rates for corporations and slower economic growth. It’s fairly easy to see that the entire world currently is in a recession or soon will be. Exhibit 3 shows that 30-year mortgage rates recently rose to over 7%.

Think of the negative ramifications that these high rates create—slower home sales and a reduced number of new homes built. These are both a major force in the U.S. economy. The mobility of many homeowners will be crushed as rates move higher. Consider this: If a family has a current mortgage that was 3% or less just 15 months ago and they need to relocate for any reason, two problems can arise. First, the interest rate for the new home they purchase will be 132% higher than a year and half ago. Second, finding a buyer who can afford to purchase their present home at these high rates. (Currently this Federal Reserve doesn’t seem to know if we’ll have slower economic times coming!)

Complacency … Pavlov’s Market

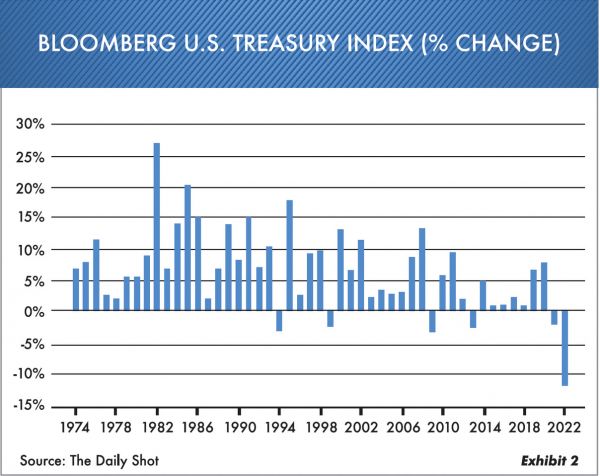

Currently one of the most confusing things for us at Oxbow is the relatively high level of investor complacency given stock market losses. It reminds us of the 1897 discovery by Ivan Pavlov of learning through association, comparing the ringing of a bell with the start of dogs salivating, a conditioned response. In the stock market, Pavlov’s theory has been the Fed. Most investors have gotten virtually hypnotized by the Federal Reserve invariably lowering rates and propping up assets. Exhibit 4 shows the sentiment of the American Association of Individual Investors.

Look closely at this graph. The red line shows that individual investors are currently less positive than they have been at any time the last 30 years. The green line shows that individual investors currently own as much stock as ever. What gives? (This is a clear sign of complacency.) In our opinion, the majority of investors are not yet reacting to the sharpest stock market decline that has occurred over the past 12 years. (Case in point: 66 days down in late 2018 and 28 days down in March 2020.) In recent years the Federal Reserve has always come to the rescue. But in 2022 we are nine months into a bear market, and the Fed is seemingly handcuffed by its attempt to fight inflation and can’t justify lower rates.

Wall Street … Forever Optimistic

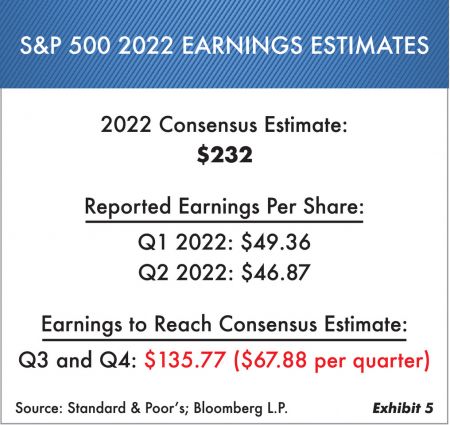

Wall Street firms continue to make current-consensus earnings estimates for the next 12 months. Let’s face it: They get paid to sell you things. Notice Exhibit 5 showing their S&P earnings estimates for 2022.

After subtracting reported earnings the first two quarters of 2022, you can readily see what has to happen during the second half of the year to reach their $232 estimate. We would need a 40% increase in earnings over the last two quarters of this year! Wall Street firms historically wait until the last minute to lower their estimates, but by then it’s too late. The herd has moved on.!

Inexperience Abounds …

A message we have repeatedly written about is the lack of experience by so many people in the investment business today. More than 40% of advisors have been around less than 12 years. In addition, a high percentage of older advisors have sold their practices or retired. The younger advisors have never experienced a long, drawn-out, negative stock market or high inflation. This business has been a “plug and play” game for a lot of these people, and they know very little about analysis. The investment business has few barriers to entry, so everyone can become a “wealth manager.” Why not? Markets always go up—right? The standard advice is to stay invested and don’t make changes.

Another factor of concern is that we expect the current stock market to remain tough to handle. We at Oxbow are happy and proud to say that our younger advisors and portfolio managers have been well trained.

Our job at Oxbow is to help get investors through negative markets with the least amount of damage. As we have said many times, you have to manage risk in order to survive the downturns. Many asset bubbles that have occurred over the last decade have been caused by loose money. This at times has included stocks, real estate, private businesses, homes, art, crypto, NFTs (non-fungible tokens) and SPACs (special purpose acquisition companies). When super bubbles occur, it takes time to get back to normal valuation levels. Should economic conditions change, we can always adjust the other way. With European troubles, Ukraine, inflation and slower economics, things bear watching. Not to mention Russia recklessly throwing around the nuclear threat.

In short, try not to get overly pessimistic because there could be some great investment opportunities developing in the next 6–12 months. But you will need cash or cash equivalents. At Oxbow we’ll do our best to watch for these investment opportunities.

A big thank you for investing with us. Since our next letter will be in January 2023, we wish you all the best during the coming holiday season.

Ted Oakley

Bob Walsh

“Inflation is made in Washington. Only Washington can create money.”

–Milton Friedman

“If you put the federal government in charge of the Sahara Desert, in five years there would be a shortage of sand.”

–Milton Friedman

Ted Oakley’s New Book Now Available

Order Below

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.

Please fill out the form below for your complimentary book.

Don’t forget to visit our Books Page for your complimentary print and digital copy of Ted Oakley’s new book Your Money Mentality.

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.