On Edge

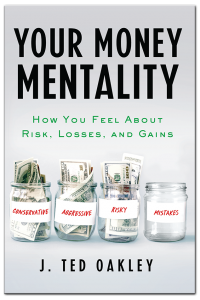

Most investors and even non-investors seem to be on edge these days. It doesn’t really depend on age either, as we detect this feeling across all age groups. One of the things we’ll discuss in this letter will be the reasons for concern and their outcomes. The quarter ended September 30, 2021, on a down note with major stock market averages falling some -4.5% or more in the month of September alone. Year-to-date performance was still positive despite some recent weakness. Exhibit 1 shows investment returns of various popular market measurements for the first three quarters of this year ending September 30.

On Edge for Many Reasons

When you look at the many things that investors have to presently contend with, it becomes quite apparent why all the confusion. Considering COVID-19 (vaccines, no vaccines), taxes going up, $3.5 trillion spending bill, schools (rules and regulations), declining confidence in government and lastly, a Federal Reserve that says, “No inflation.” Young people tend to struggle with little money to speak of; consequently, they often turn to speculating in cryptocurrencies. Meanwhile, most people over 60 years of age are also confused about what to do. Do I have enough money? Can the stock market returns keep going up?… We could go on and on, but it’s very apparent from looking at the big picture that almost everyone is on edge about something.

‘Don’t Worry About Inflation’

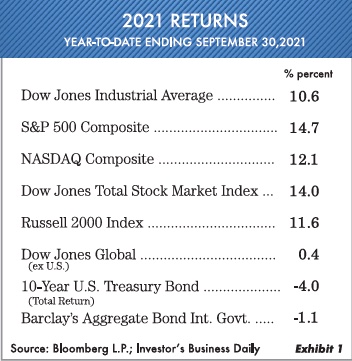

These are the words spoken by your Federal Reserve that wants you to know that inflation is under control. When you look at these comments, you have to wonder what they’re thinking! For example, Exhibit 2 shows the price increase of gasoline per gallon nationally over the past year.

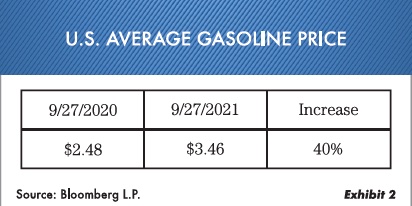

Up 40% in 12 months. For all the people who drive, do they think this is inflation? We bet they really look at it as inflation. (Perhaps the Federal Reserve board members don’t drive, or better yet maybe they fly!) In the budgets of the average American consumer, food, energy and rent stand out. All of these are what makes up inflation. Could it go the other way, with prices coming back down? Yes, but this is now—not the future. Another area that hasn’t done well this year is bonds and bond funds. As an example, the returns on the 10-year and 30-year U.S. Treasury bonds can be seen in Exhibit 3.

What Is Inflating?

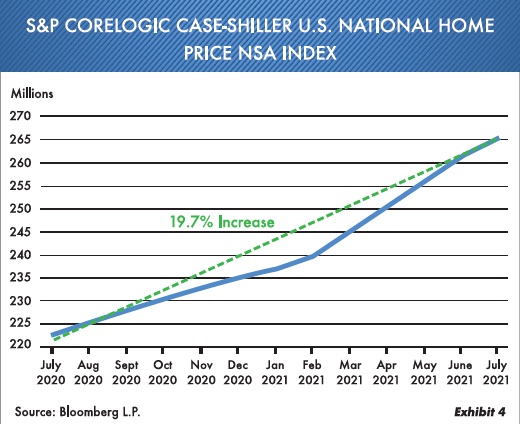

How about virtually everything is more expensive! First and foremost, the Federal Reserve monetary policy is almost totally responsible for the expensive stock and bond market prices. Their values are certainly inflated. By flooding the markets with low interest rates, the Fed has created one of the most overpriced speculative markets in history, by being “in bed” with Wall Street all the way. Sadly, the Fed lost its way a number of years ago and now has bought in to everything. What else is inflated? Notice Exhibit 4 showing the one-year national average increase in home prices from July 2020 to July 2021.

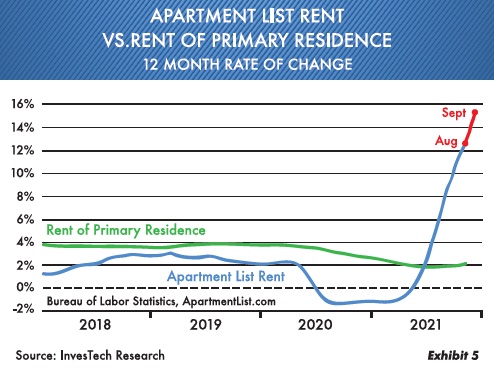

Does this look like inflation? Jay Powell, the Federal Reserve chairman, keeps insisting it is only temporary. Temporary? How is that true since homebuyers over the past year or more have already bought at high prices? Is there a refund coming somewhere? In addition, notice that nationwide rental prices have surged as shown in Exhibit 5.

According to apartmentlist.com, rents have soared almost 19% the last 12 months. The line that shows rent of primary residence is a lag effect. The question for the homeowner is … What would you rent your house for, absent utilities? It catches up in time. Do you think those rental rates are coming down anytime soon? This is real inflation, not temporary. But try telling that to the landlord. These are all things the Federal Reserve miss because they live in a different world of academics and not on Main Street.

You Heard It Here First

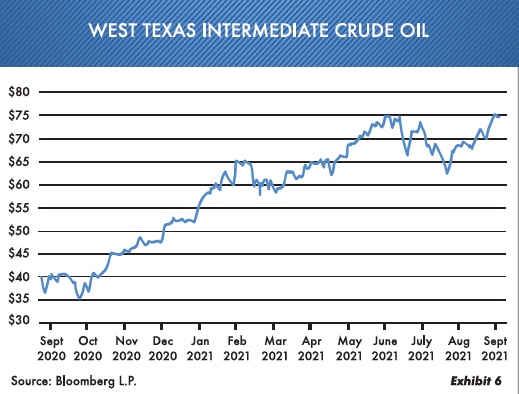

Over the last year at Oxbow, we have repeatedly said that energy prices would rise. In our high-income strategy, we have a large exposure in this area. You may remember in our quarterly July 2021 review we mentioned the probability of ever-increasing prices in energy. We also stated that while we are always in favor of a cleaner environment, it will be almost impossible to reach the timelines for green energy. The numbers just don’t work. Notice in Exhibit 6 where oil prices have doubled in the last 12 months.

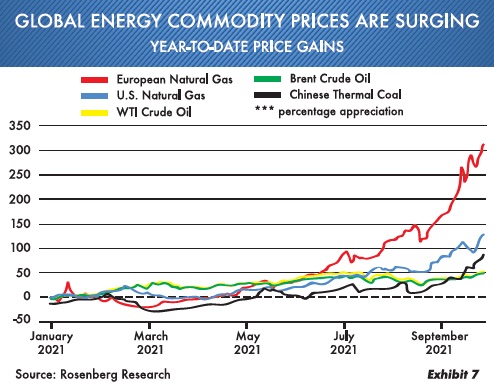

This country can’t make a dramatic shift away from fossil fuels like this when so many things depend on energy. It isn’t just gasoline but many manufactured items that rely on present forms of energy. It wouldn’t surprise us at Oxbow to see energy prices go considerably higher as we move forward. In addition, natural-gas prices are skyrocketing. If you look closely at Exhibit 7, the prices of energy worldwide have moved substantially over the last year. In Europe electricity costs are up almost 300% due to rising energy costs. All of this is happening while environmentalists are trying to ban fuels. The world isn’t equipped to do this at this point in time.

Cryptocurrencies and NFTs

The present investment environment is likely to go down in history as producing one of the most speculative excesses ever experienced. The main reason is due to the Federal Reserve’s accommodative monetary policy where money is almost free. This in turn has led to extreme investor speculation where mania is rampant. In addition to a host of overvalued stocks with no profit, zero return on bonds and SPACs, we now have the crypto craze. For all Oxbow investors who may be wondering about crypto, in short it’s a digital currency recorded in a computer database. The software that secures transactions also verifies the transfer of the crypto. The unit of crypto is generally referred to as a “coin,” but it is only in digital format and not a real coin. The idea behind this non-centralized currency is that it isn’t controlled by central banks.

What has happened is the proliferation of too many cryptos; now that number is 6,000-plus. There will probably be even more cryptocurrencies in the future. In our opinion, however, there will be substantial losses as most people have no idea what they currently own. In some ways it’s like the tulip mania of the 17th century, where Dutch investors bid up tulips to unbelievable levels until one day they said, “These are just tulips.” A crash ensued, and investors lost a lot of money. In our view a similar fate awaits a number of the crypto coins.

Meanwhile, NFTs (non-fungible tokens) are a unit of data on a ledger that can represent such items as photos, videos or pictures. They are stored in digital format—only not as something you can touch. Here’s the problem as we see it. When you stand back and look at the NFT pictures, it’s easy to realize that people are currently paying thousands and millions of dollars for them. Notice the pictures below, which represent three different types of NFTs currently selling for millions in some cases.

Unfortunately, many investors actually think this is a form of modern investing in luxury goods. But in reality, it appears to be a get-rich-quick scheme, only waiting to see who is left holding the bag. In short, this is just another example of obtaining wealth via massive speculation. We believe that the vast majority of amateur investors, in the end, will not attain what they expect.

While we have covered a number of topics in this letter, it is safe to say that we at Oxbow Advisors, are still investing the old-fashioned way: good companies, solid cash flows, and investments that make sense.

We want to wish everyone a great Thanksgiving and holiday season and let you know that Oxbow appreciates you, all

our investors.

Ted Oakley

Bob Walsh

“You don’t pay taxes … they take taxes.”

–CHRIS ROCK

“Yes, I would.” Treasury Secretary Janet Yellen when asked if she would have NO debt ceiling limit.

(September 30, 2021)

Ted Oakley’s New Book Now Available

Order Below

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.

Please fill out the form below for your complimentary book.

Don’t forget to visit our Books Page for your complimentary print and digital copy of Ted Oakley’s new book Your Money Mentality.

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.