A Lot of Moving Parts

As we end this year’s third quarter, investors are faced with myriad questions about almost every aspect of their lives. A look at 2020, with all the problems and unexpected outcomes, has left us with a sense of being “not normal.” Think about a potential huge stock market decline, a Federal Reserve gone wild with money, a huge market rally, ongoing COVID-19 issues, election jargon, debates, Supreme Court nomination and China problems.

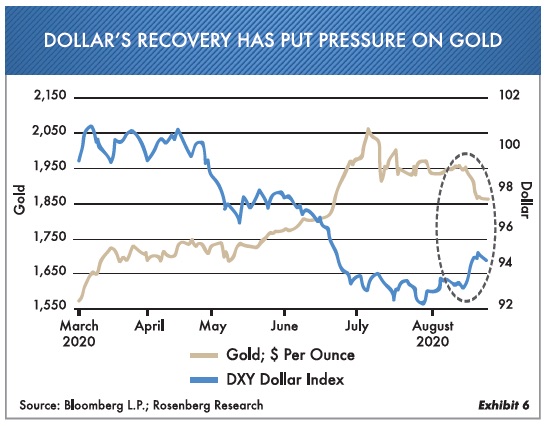

With these many overriding uncertainties, here we stand in early October with the markets nearly at a break-even point, except for a few big-tech names. Returns for the nine months ended September 30, 2020, as recorded by various major market measurements are presented in Exhibit 1.

The biggest question facing investors is where do they make any money? With low interest rates, stocks are expensive, and real estate is tricky. In this letter we hope to give you some idea of how we at Oxbow are structured and the reasons for it. Let’s start with interest rates.

We Never Expected This …

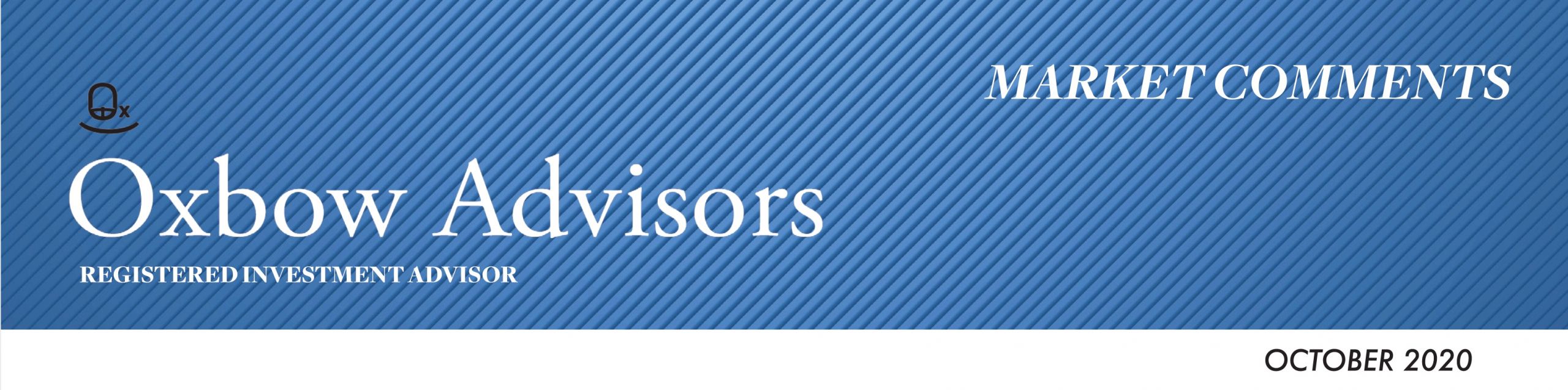

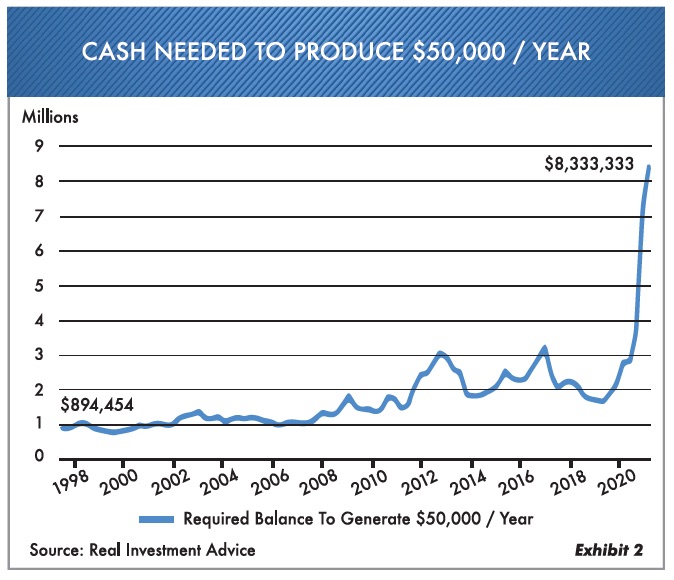

Interest rates have come down so far that the average person can’t even grasp how low they have declined. Notice in Exhibit 2 the amount of money that would be needed to produce $50,000 of annual income by investing in government bonds. In 1998 it took less than $1 million, and now it takes $8,333,333! So we end up with a problem. Most upcoming retirees never saved any money. Now many investors are chasing yield in the riskiest assets. Sad to say, the Federal Reserve has overstepped its bounds. They were never meant to put money in the hands of everyone in the country. Unfortunately, it has gone so far that no elected official has the courage to make the Federal Reserve normalize interest rates. They all need the Fed to keep printing money if they are to stay in office.

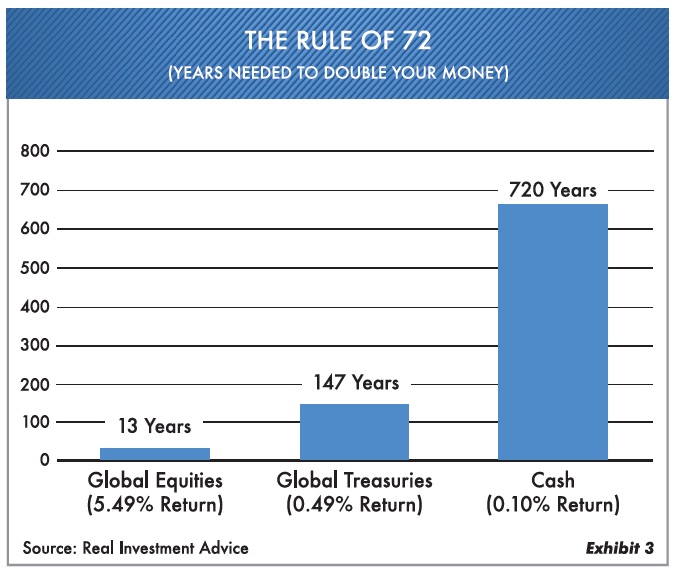

What happens if you buy these low rates? Presently, the rate of interest on U.S. Treasury bonds is 0.12% for one year, 0.65% for 10 years and 1.19% for 20 years. The question is, where will rates go from here? We don’t know. But one thing for sure is that extremely low interest rates change the investment landscape. Notice Exhibit 3, which shows what happens by applying the Rule of 72. (As you may recall, this mathematical rule has been around forever.) It’s a simple way to determine how many years it takes for an investment to double in price by dividing the return into 72. As an example, a 7.2% return doubles in 10 years. Exhibit 3 shows the eye-opening number of years it takes for various investments.

Where Are Stocks Going?

Again, we don’t know—but we do know when companies’ stock prices fall into our value zone. Chance Finucane, Oxbow’s Chief Investment Officer, has done an excellent job this year navigating the maze of market movements. Even with high cash reserves, he has bested the overall market returns. The stock market has become riskier as the months have gone by. A few things come to mind. Small individual investors have returned en masse to day trading. Trading volume at online brokerage firms has exploded, with no commissions and unlimited time at home … it’s a virtual casino. These are mostly young, first-time traders who seem to think the markets never go down. In addition, 2020 will be a record year for IPOs (initial public offerings) and SPACs (special purpose acquisition companies). All this is speculation at the highest level. It appears that most investors just don’t understand what they are buying.

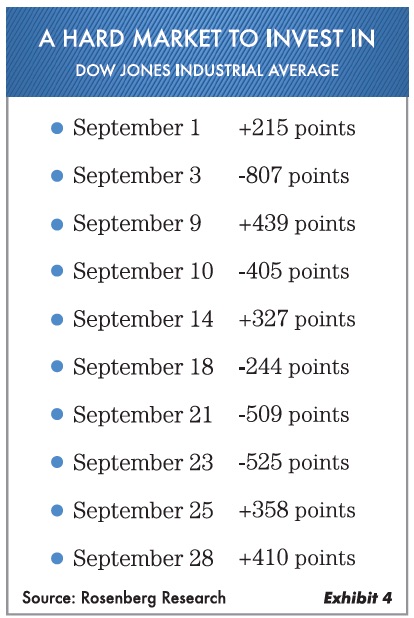

The problems facing investors today relates to extreme volatility and so many investments that simply don’t make sense. With the markets in full-tilt movement daily, investors are getting worn out. For example, the price fluctuations in the Dow Jones Industrial Average just in the month of September 2020 are shown in Exhibit 4.

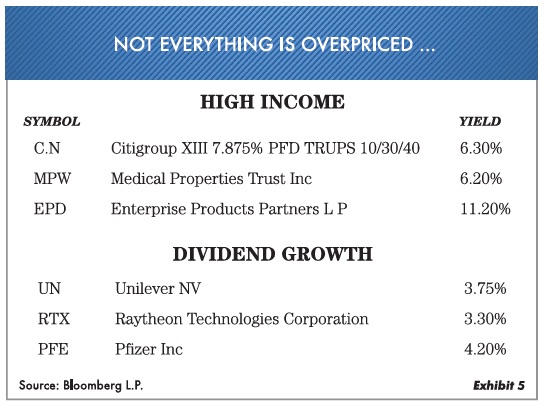

At Oxbow we continue to find stocks and income items that will pay well over the next few years. With most investors focused on the big-tech stocks and index funds, they tend to forget that cash flow is important, especially in the present market environment. If we stay in a slow-growth world, cash flow from either common stocks or dividends will be important. Notice in Exhibit 5 some of our current holdings. Keep this in mind when deciding what to own.

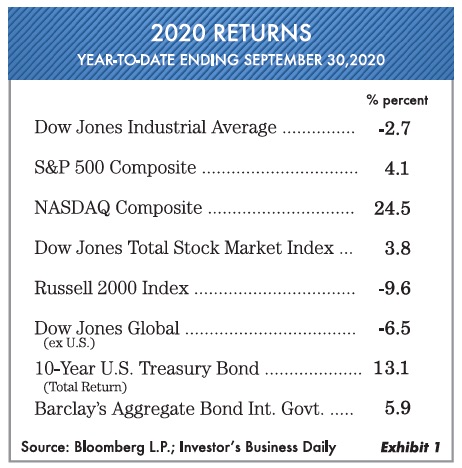

A Word About Gold …

As most of you know, we at Oxbow Advisors believe we are in a gold market that can potentially move higher. One of the things that we are watching is the strength in the dollar. Historically, gold does very well in the midst of uncertainty, not just inflation or deflation. It is interesting to note that Warren Buffett, who never liked gold, has now made a major purchase in Barrick Gold Corporation (GOLD). In all of our income accounts, we have a position in gold. What we have to look for now is how much the dollar strengthens as that would stall the gold rally. Exhibit 6 traces the movement of the dollar versus the price of gold since March of this year. Notice the correlation of a strong dollar and weaker gold. We will closely be watching this movement.