Give It Some Time

This bear market is entering its 16th month and is starting to weigh heavily on investors’ minds. When coming off a super bubble high, like it has been since January 2022, every asset class takes a long time to wring out the excesses. Many investment advisors today have never experienced 16 months of declining markets. Consequently, this is a reason why they keep trying to time the so-called “bottom” of the market to no avail. Exhibit 1 shows the investment returns of various popular market measurements for the first quarter of this year ending March 31, 2023.

And It’s Still Not Cheap …

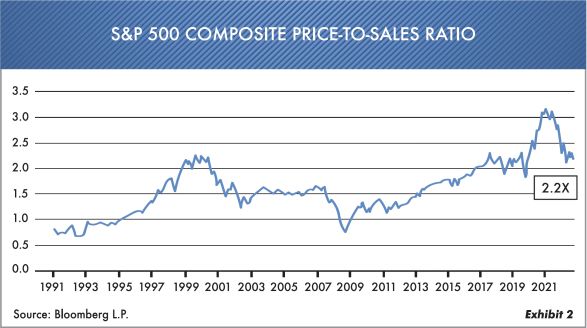

When looking at present valuations relative to upcoming earnings and GDP (gross domestic product) figures, this market still can’t be classified as cheap. Looking at price-to-earnings, price-to-dividend and price-to-book values, they are all still at lofty levels. At Oxbow we have said for some time that we are not market timers but value timers. A historically good measurement of value can be seen by looking at the price-to-sales ratio of the S&P 500 composite. Exhibit 2 shows this ratio from 1991 to the present.

Notice anything odd about this graph? Look at the current level of price-to-sales at approximately 2.2 times sales. Interestingly enough this has only come down to the high in the “dot-com bubble” before a three-year bear market. In the words of the 1970 song by the Carpenters, “We’ve Only Just Begun.” In order for this market to be cheap there would have to be more correction. It may not happen, but that still does not make it cheap.

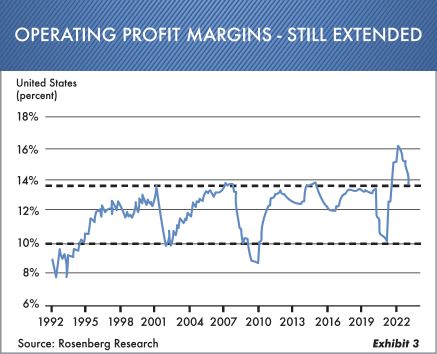

We believe that with present operating profit margins moving lower … earnings will follow. More companies are missing earnings estimates now, and this should also have an impact. Notice Exhibit 3 shows operating profit margins declining but still elevated when making historical comparisons.

Speculation Is Still Here …

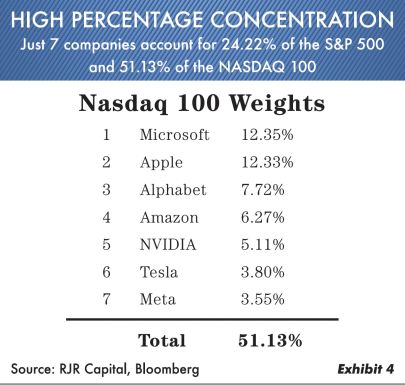

We thought speculation in the markets got tempered a great deal in 2022. But in reality, it did not. We still have huge day trading in speculative options, meme stocks like GameStop, huge option positions in Apple and Tesla, and the re-emergence of Bitcoin. The top seven stocks in the NASDAQ composite make up an inordinate amount of its market average. A high percentage is also true of the S&P 500 Composite. Notice Exhibit 4 showing the large percentage that those stocks represent in the NASDAQ 100.

The present situation is likely unsustainable. When investors are piled into just a few stocks, the odds of disappointment increase. One of the characteristics of bear markets is that they eventually impact even the stalwart stocks. While these seven have certainly held up well so far, we would caution against being overweighted in them.

Bonds, Bonds: What Do We Do Now?

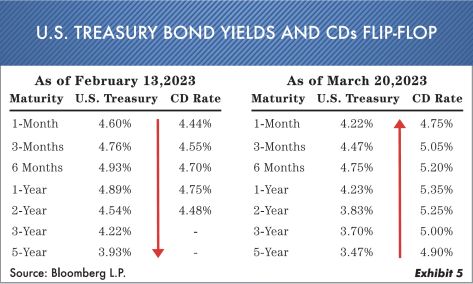

Over the last 30 days there has been increased volatility in bond yields. The recent banking crisis plus what the Federal Reserve’s monetary policy is doing have added more uncertainty to the market today. Fortunately, at Oxbow we have always kept most of our liquidity in U.S. Treasury bills and kept cash under $250,000 in bank sweeps. As shown in Exhibit 5, bond-yield comparisons from mid-February 2023 to mid-March 2023 have flip-flopped.

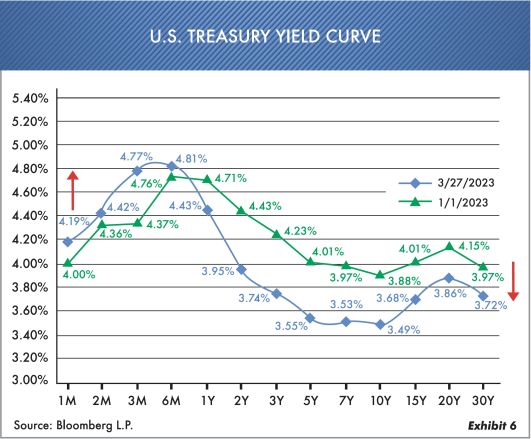

For the longest time, while banks were asleep at the wheel, the U.S. Treasuries paid more than CDs. When the liquidity problem arose with depositors leaving, banks had to pay more for CDs. One of the problems in 2022 was that banks were slow to raise rates and overestimated what individuals were going to do with deposits. The spread got too high, and the Treasury bills got a lot of people moving money around. As we move closer to slower economic times, we at Oxbow will gradually own some longer-term bonds. The bond market is tricky now because investors have a hard time understanding that as you have economic weakness, the longer-dated bonds do better. For instance, notice Exhibit 6 showing the yield curve on January 1, 2023, and today.

What you see in the exhibit below is that long-term yields (25-30 years) have actually declined since January 1, 2023. The Federal Reserve has been raising short-term interest rates for a year now. As we get closer to a recession, interest rates will peak, then in the future start to decline. We think this is starting to happen. It doesn’t mean they decline immediately, but we’re obviously closer to that peak. What this signals to us at Oxbow is that the time is approaching for us to begin buying more long-term bonds. If, as an investor, you have all your fixed income in short-term (90 days or less) investments as the economy slips lower and rates decline, you have no protection. We plan on adding to our longer-duration holdings in the coming months.

Give It Some Time …

We have titled this issue of Market Comments “Give It Some Time … ” because this is the stage in the market cycle when investment mistakes tend to be made. Investors get impatient and want to jump into the market. History shows that during “super bubble” times asset levels can’t be corrected at the drop of a hat. There was just too much free money being loaned at virtually nothing in 2020-21, and some of that money is still being used today. The high in U.S. markets in late 2021 was as speculative as we have ever seen! The present market environment is more akin to the 2000 “bubble” market.

We’re pleased to report that Oxbow-managed investment portfolios are now and have been invested in a very high percentage of safety. This strategy has helped us over the past year to sidestep some of the major damage. If certain stocks or bonds meet our criteria, we will certainly deploy cash, but currently we are not seeing those opportunities. Presently our investors are getting paid a nice yield to wait and see what the future holds. In addition to our upcoming quarterly video, we have Louis-Vincent Gave, Lacy Hunt and Neil Howe on tap for some good interviews in the next three months.

In short, our advice as of now is to be patient and give it some time. We wish you a great spring and summer.

Ted Oakley

Bob Walsh

“It takes character to sit with all that cash and do nothing. I didn’t get to where I am by going after mediocre opportunities.“

-Charlie Munger-

“You don’t have to be great to start, but you have to start to be great.”

-Zig Ziglar-

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.

GET YOUR COMPLIMENTARY COPY OF TED OAKLEY’S BOOK

Your Money Mentality

Order Below