What, Me Worry?

Over the past years you have probably seen the following face below on the cover of the timeless Mad Magazine. Just in case … we included it to refresh your memory. Alfred E. Neuman was the fictitious character in Mad who always had things under control—much like the Federal Reserve thinks it does today.

This phrase has been thrown around for years, but in current days and time … it rings true. In this Market Comments we discuss how it seems to be that almost no one is worried or skeptical about anything. Stocks are up, bonds are doing OK, real estate is up, and cash is in the bank. We at Oxbow have some concerns about the present high degree of optimism and complacency on Wall Street. Therefore, we feel it is worthwhile to dig below the surface for a better look at some extremes that exist … signs of the times.

For the quarter ending June 30, 2021, results improved somewhat over the prior quarter as the economy was digging out of COVID-19 problems. Exhibit 1 shows investment returns of various popular measurements for the first half of this year.

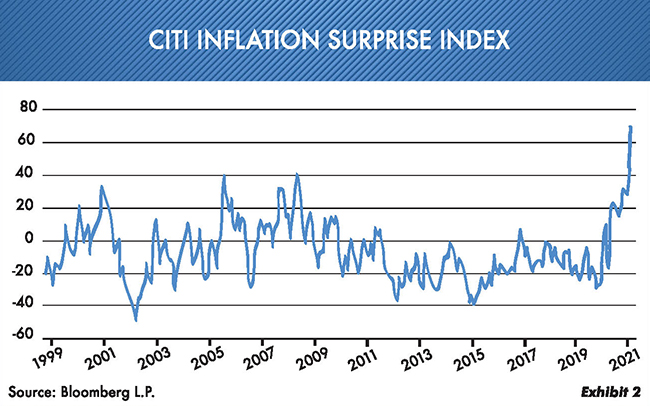

Transitory Inflation: The Fed Isn’t Worried

You are probably as tired as we are of hearing the word transitory. Jerome Powell (Federal Reserve chairman) has evidently decided higher inflation is fleeting, and it may exist for only two calendar quarters. But those of us with longer memories know that the Federal Reserve’s often poor record automatically creates skepticism. Unfortunately, the Fed rarely gets it right. At this time no one knows for sure whether inflation is here for good. Consequently to diversify, we at Oxbow have increased our exposure to select commodities – energy, metals, timber and fertilizer. If the Federal Reserve gets caught behind the inflation curve these items should do well.

Notice in Exhibit 2 the Citigroup Inflation Surprise Index. It now stands at a 21-year high. This high reading all started to develop about 2½ years ago in December 2018. Led by Jerome Powell, the goal was to normalize interest rates. But as soon as the stock market fell 9.2% that month, the Fed turned on the money spigot. Since that time, they have created the most speculative bubble since the Tulip Crash of 1637 or the John Laws Mississippi Company bust in 1715. They still contend that inflation will be a fleeting (transitory) two calendar quarter phenomenon and not to worry. But we do worry—because we have been around too long and have seen most Federal Reserve promises not come true. This idea that they can control the U.S. economy leaves us not so sure. The last time inflation was hot (in the 1970s), the average age of the current six-member Federal Reserve Board was about 23.

If inflation numbers don’t abate within the next three quarters, the Fed is in a bad spot. Raising rates to curtail inflation likely breaks (or at least severely impacts) the stock market. If they don’t do that and inflation runs wild, the markets break anyway. Should they keep up the current stance of buying Treasury and mortgage bonds, we see that as a road to much higher inflation.

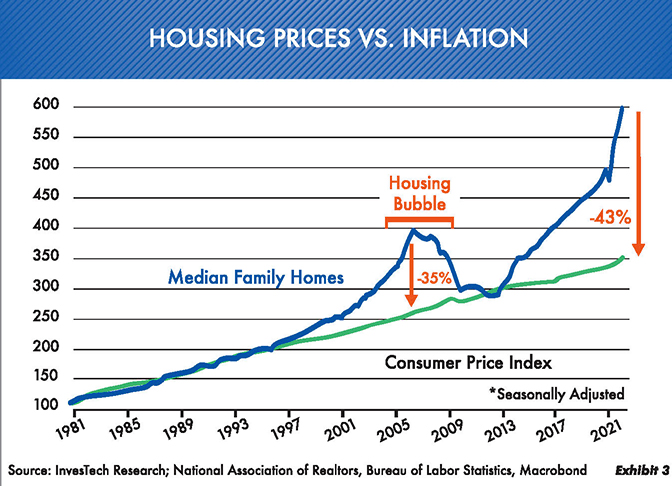

Real Estate … No Worry Here

The easy-money climate, which has been created by the government and the Fed, has led to all-time, record-high prices in real estate. Recent word from NPR (National Public Radio) is that there are currently more realtors than homes for sale in America. Prices are crazy everywhere. This reminds us of the popular 1970s Crosby, Stills, Nash & Young song lyric, “Our house is a very, very, very fine house” except now insert expensive. Notice in Exhibit 3 the home price to inflation rate.

In the past, home prices have tracked closely with inflation, except during the 2005–07 subprime mortgage bubble. But today it’s even worse, with prices off the charts. The big bugaboo today could be a rise in rates brought on by, yes, inflation—perhaps causing as much trouble as subprime. Interestingly, almost no one seems worried because they never thought their home would have this much value. While residential real estate is very expensive, our exposure with REITs (real estate investment trusts) at Oxbow has been a solid performer. These REITs still offer above average yields of cash flow. While not all businesses will return to office space, we do see a real increase in our holdings in medical REITs.

Stocks Have Been Great … No Worry Here

Investors today appear much more interested in returns than the level of risk. The first question we are usually asked by potential investors is: “What have you returned the last five years?” What should be asked is: “What will happen to my money over the next five years?”

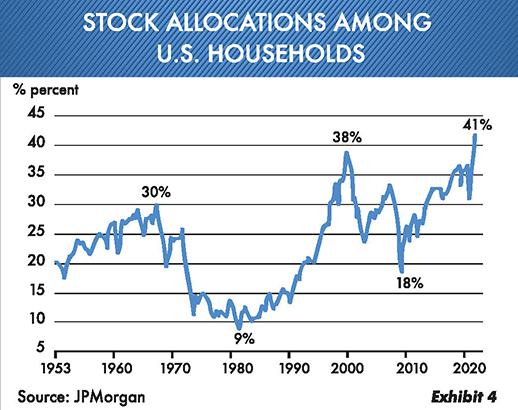

Notice in Exhibit 4 how stocks held as a percentage of total financial assets have currently risen to an extreme 70-year high of 41%. This well exceeds previous percentage ownership highs in 1968 and 2000. While individual investors are at extremes in their exposure to stocks, Oxbow is not at that level. We definitely are still invested but have a cash buffer as well. These years ahead are going to demand that an investor really know what they are invested in. Chance Finucane (Chief Investment Officer) has done an excellent job of owning the right companies, but more importantly knowing when they are at value levels.

Another concern: The investment business has an enormous number of people within the financial industry who have zero experience during difficult market times. This could become a future problem.

Wall Street? Not Worried for Sure

Over the last 12 months we have seen what usually takes place during market highs. Peak prices in almost every category, including IPOs (initial public offerings), special-purpose acquisition stocks, penny stocks and call options. None of these speculative areas are where we invest at Oxbow. In addition, we have never found the initial public offering market to be a good value in most cases.

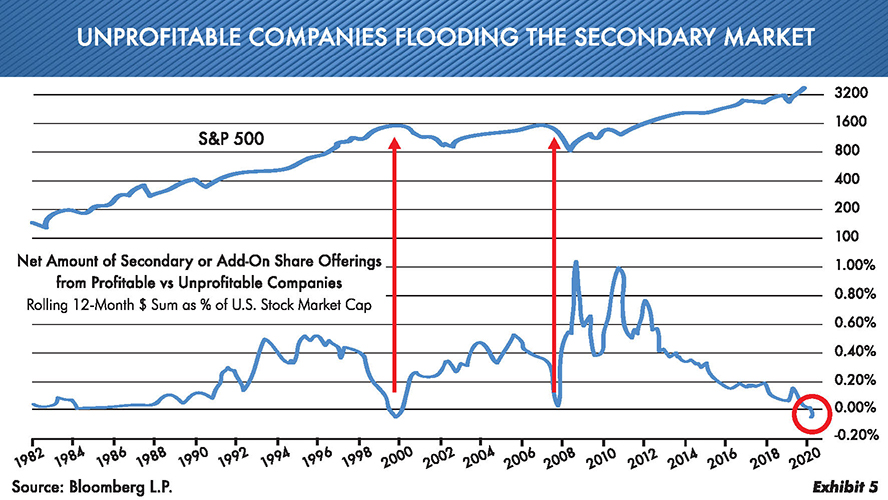

Notice how Exhibit 5 shows the number of secondary or new stock offerings that are losing money. What you see is a 40-year extreme of more losing companies than profitable ones coming to market. To say again, stay with real value and growth and don’t get caught up in fads.

Oxbow Does Worry—and Gets Paid to Do So

In short, this leaves us with the big question: What should an investor be doing now? At Oxbow we believe that you need to be balanced to control risk. This does not mean new investors should assume that a commission-free account and day trading are the right things to do. The amount of craziness is greater now than ever before. Cryptocurrencies (Bitcoin and 4,000 others) represent over 1 trillion dollars with absolutely nothing to offer investors in the way of cash flow. Remember, cash flow is the absolute No. 1 thing in any investment. Yes, a few of these currencies may survive, but the dilution will be huge. Balanced does not mean the current rage of “meme” investing (something made up) or NFT (non-fungible tokens), a form of esoteric digital art.

What balanced means is owning a portion of assets in stocks; a portion in conservative income; a portion in higher cash flow items; a portion in real estate; and a portion in gold, energy and certain inflation hedges. And last but certainly not least, we advise having a portion in cash, which is a natural insurance policy to help capitalize on potential future lower prices.

Many people are completely dismissing any problem in investing because the Federal Reserve will take care of them. At Oxbow we believe differently. At all times we have to remain vigilant by really knowing what and why we own each of our holdings.

Fortunately, our returns in both stock accounts and high income accounts are doing well again this year. In conservative income portfolios, returns have been much better than the average fixed income account. On the other hand, we currently see a number of people who are investing in a fantasy world. You can depend on Oxbow to not go in that direction.

As always, we appreciate your confidence in our entire group of professionals. Please call or email us with any questions at any time. All our best to you this summer.

Ted Oakley

Bob Walsh

“The happiness of your life depends upon the quality of your thoughts.”

– Marcus Aurelius (Roman Empire)

“Never let the future disturb you. You will meet it, if you have to, with the same weapons of reason which today arm you against the present.”

– Marcus Aurelius (Roman Empire)

1-877-604-5707

Email: info@oxbowadv.com

Website: www.oxbowadvisors.com

Psychology of Staying Rich

Order Below