Don’t Worry … Be Happy

Most investors finished 2024 in a great mood. With almost every type of investment doing well, there was little to worry about. This reminds us of the song, “Don’t Worry, Be Happy” by Bobby McFerrin, which in September 1988 reached No. 1 in the U.S.A. Later in this issue we’ll discuss why this pervasive attitude may need some tweaking.

We’ll also discuss where we are invested and what was best for us at Oxbow Advisors in 2024. In the beginning of the letter, you’ll see our caution about lofty prices. But in the end, you’ll see how Oxbow traverses that situation. So be sure to read it all.

For now, returns from various popular market measurements for the year ending December 31, 2024, are shown in Exhibit 1.

Diversification: Who Needs That?

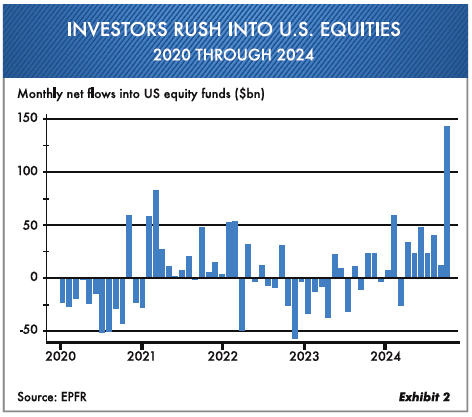

Most investors have over 70% of their financial balance sheet in stocks. Heading into 2025 they see virtually no problems. They believe that there’s no recession risk, that no one sells stocks anymore … and this goes on endlessly. Notice Exhibit 2 showing that investors poured more money into stocks this past November than in any month the last five years. And that was at all-time highs in the market averages.

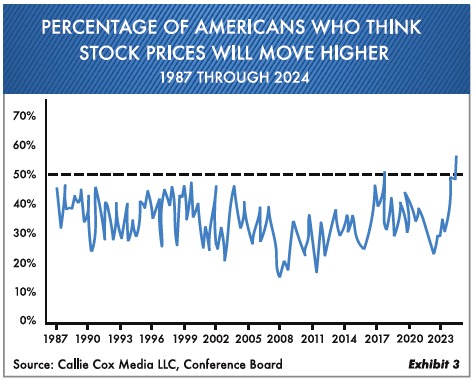

This period we are in is marked by most investors seeing little or no difference between risky and riskless. Keep this in mind. The 2025 future-earnings yield on the S&P 500 (inverse of p/e) is 4.1%. Compare that to the U.S. Treasury three-month yield of 4.3%. Normally the premium to own stocks is 3–4% over the risk-free Treasury. Now there is essentially no difference, i.e., many people are saying no risk here. We are obviously humble enough to know we can’t predict the future, but we can look at companies and know when prices are too high. This is not unlike paying too much for real estate or private businesses, which investors know better than to do. While investors think markets are great, they also assume prices will do nothing but go higher. Notice Exhibit 3, which shows the percentage of Americans who currently think prices will move even higher.

This chart shows that Americans seeing higher prices is at a 35-year high. In addition, they fail to realize that foreign investors in U.S. stocks are at 60%, a 70-year high. What we are trying to convey is that seemingly everyone is in the U.S. stock market, and there is little room for disappointment.

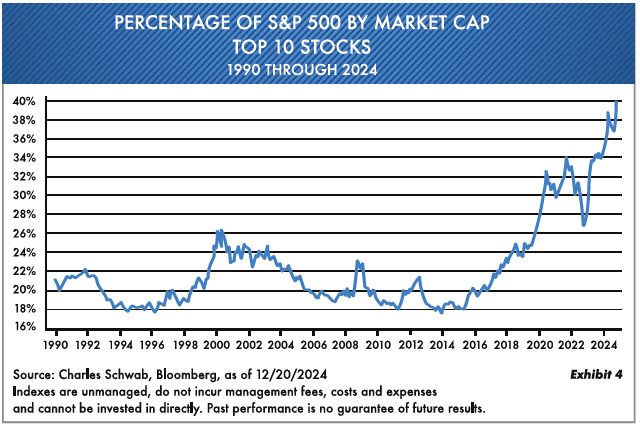

At Oxbow we’re always looking at specific companies and free cash flow. There aren’t many around right now, but there have been a few. People buying the S&P 500 index and the high-flying, top-10 stocks don’t realize that they are heavily concentrated. What that means is, if anything goes wrong people all sell the same thing. We call this the one-button sell.

Notice Exhibit 4 showing the makeup of the S&P 500. The top-10 stocks make up 40% of the total market cap. Question for you: Would you buy real estate in the U.S.A. if 40% of it was in just a few places?

Bond Investors Have No Memory

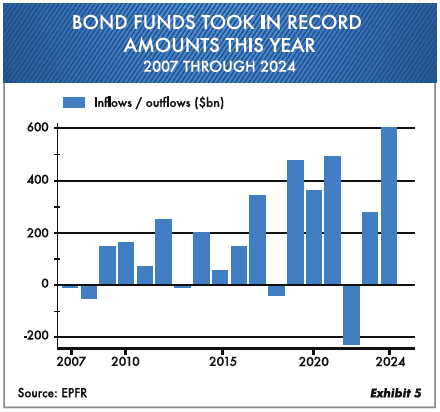

Our main comment to investors has been to keep your maturities of bonds, CDs and U.S. Treasury issues short term, meaning less than 30–36 months. We are in a different time now, and even if the Fed lowers rates this year to keep interest costs down for the government, it will be, in our opinion, a short-term phenomenon. Later on, the rates go even higher because inflation comes back. Try not to get sucked into the idea that rates will stay down for a long time. They may, but inflation higher than rates will erode your buying power. Investors still can’t get enough, as shown in Exhibit 5. Bond funds took in new funds in 2024 at an 18-year high.

How do you think the people who bought 40-year Apple bonds paying 2.55% feel now that they have lost -40% of the price? Or the people who bought the Austrian 0.85% bond due in 100 years, now at a -59% loss. If you own longer-term bonds and rates come down, trade them is our advice at Oxbow.

What Has Oxbow Been Doing?

The year 2024 proved to be a good one at Oxbow Advisors for a number of reasons. We kept maturities short for bonds, so our conservative accounts did much better than the bond averages. In addition, we locked in some nice two-year yields. Our gold allocation in conservative, fixed-income and high-income accounts did very well. Gold had a return as good as the S&P 500, but few people noticed. In Oxbow long-term-growth accounts, Chance Finucane, our chief investment officer, did an excellent job of finding the stocks that were still good values. In addition, he took us out of situations that had become overvalued.

Our best-return stocks in 2024 were Entergy (+56%), ServiceNow (+53%), Expedia (+50%), Booking Holdings (+44%) and Gilead Sciences (+38%). In addition, we have a great buffer in our stock accounts of short-term U.S. Treasury issues. The Oxbow high-income accounts also returned well. In high income our best returns were MPLX (+37%), Agnico-Eagle (+47%), Kinder Morgan (+61% sold), Williams Companies (+65%) and Energy Transfer (+45%). Across all strategies, we averaged approximately 60% in short-term Treasuries.

As we come into 2025 a number of changes will start. A new president, maybe tariffs, a confused Federal Reserve and worldwide upheaval. We believe that our portfolios are positioned for playing defense, yet they can easily get more aggressive if the right prices show up. Most investors are numb to the possibility that anything could go wrong. Perhaps they are right, but it doesn’t show up in the prices we are seeing. So many of the people in the wealth business have never seen higher interest rates or higher commodity prices. They have never had to be nimble when it comes to actively managing portfolios. That skill, however, may come in handy in the next 10 years.

Lastly, we want to thank you for trusting us with your investments. At Oxbow we take this responsibility very seriously and do our best to protect your investment assets. We hope you have a great and healthy 2025.

Ted Oakley

Bob Walsh

“A lifetime of investment research has taught me to become more and more humble about making predictions.”

–Sir John Templeton

“If you don’t make mistakes, you can’t make decisions. You can’t dwell on them.”

–Warren Buffett

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the authors, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.