It’s Magic

Looking back … The Oxbow Market Comments from January 2021 titled “Fantasy Meets Wall Street” in retrospect hit the nail on the head as most of the hyped-up, free-money investments came back to earth in 2022. Everything became like magic: Now you see it, now you don’t. (More on this subject later.) Exhibit 1 shows the investment returns of various popular market measurements for the year ending December 31, 2022.

A Year Makes a Big Difference

Nearly all investors came into 2022 doing a victory dance, not realizing the music was about to stop. Truth is … this past year there was no place to hide as the Federal Reserve hiked interest rates, inflation took off, and the economy started slowing. (Even the most speculative areas of housing and cryptocurrencies started to sell off.) Virtually the only safe places were cash and short-term U.S. Treasury bills, which, fortunately at Oxbow, we had a lot of. All that, however, is history, and now, more importantly, where does 2023 go from here?

First, in Exhibit 2 we have the heretofore untouchable housing market. U.S existing home sales are obviously falling rapidly as high interest rates and even higher mortgage rates take a toll. In our opinion, this situation will continue into 2023 because, as a percentage of total income, consumer spending on housing is just too much. Added to that, the need for retail spending will most likely have a very strong impact on the markets over the next two to three quarters. As Dorothy said in “The Wizard of Oz,” “Toto, I have a feeling we’re not in Kansas anymore”—meaning we have entered a place or circumstance that is unfamiliar and uncomfortable. Unfortunately, what investors got used to over the last 13 years ending in 2021 could certainly change—and it did. What if a change comes, but most investors aren’t aware of it? This may be the biggest question of all to ponder.

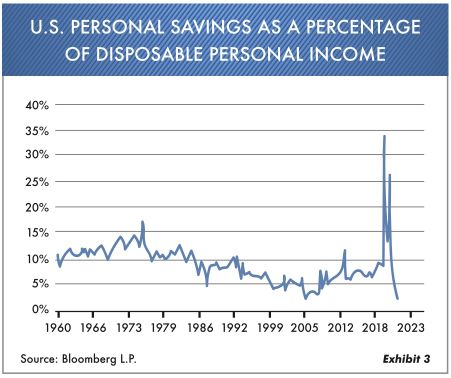

Another economic problem will be savings. As you can see in Exhibit 3, personal savings currently are at an all-time low. The majority of previous years’ savings has been spent and now is becoming a drag on consumer spending.

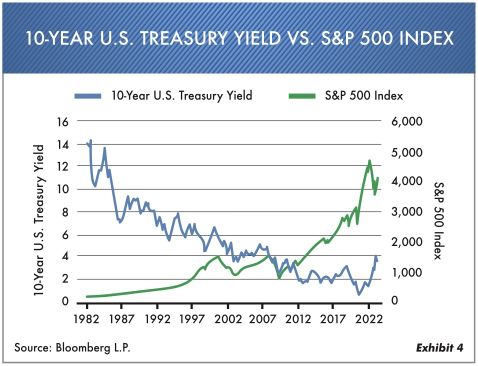

As investors, many times we forget the influence that declining interest rates have on almost every asset category. Notice in Exhibit 4 a 40-year chart of lower interest-rate yields and a higher stock market. As you can see the yield on interest rates is now back to where it was some 15 years ago in 2007. A lot of people have entered the investment management industry during that period and have no idea how to navigate the changes that are occurring. Sadly, that is all they have ever experienced. In most cases they believe it’s business as usual and the Federal Reserve will lower interest rates, thus everything reverts back to the good times. But if there really is a change coming in terms of higher inflation and lower returns, it will likely come as a real shock to the average investor who thought it was as easy as buy and hold forever. Our oldest employee at Oxbow has been through periods as long as 16 years of very limited returns, and our youngest employee has never experienced true bear markets. Quite a difference, and that is why experience matters.

A Word on the Magic …

The difference between now and past market bubbles is this: The people who sold investors all the speculative hype took cults, celebrities, individuals and institutions on a “wild goose chase” that ended badly. For example, how about this group? And this is just a few: Sam Bankman-Fried of FTX, Elizabeth Holmes of Theranos, Adam Neumann of WeWork, Markus Braun of Wirecard, Trevor Milton of Nikola and Do Kwon of Terra/Luna.

At Oxbow we were told by many that we had missed the boat by not jumping into cryptocurrency, NFTs and SPACs. But in the end, it paid to be safe. There’s a whole list of others whom the financial press groveled over, and this entire group of so-called investments has gone ungoverned. We do agree that they did a great job of converting the masses, but there’s likely a lot more damage ahead. This reminds us of a Merle Haggard song, “The Worst Is Yet to Come.” The shams, scams and get-rich-quick schemes have finally run out! Since its inception, crypto as an asset class has been made possible with pumped-up narratives to make people think they work. Ironically, the very thing they wanted was a system that protected against fraud and hacks, with safety and security built in. But in the end, it has done none of those.

2023 Outlook

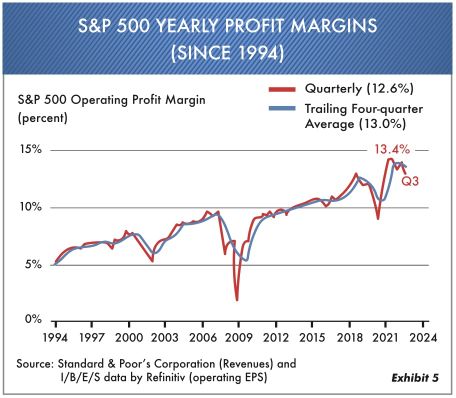

In our opinion, the first problem that publicly traded companies will have in 2023 is profit margins. In 2021 we experienced almost a 13.4% profit margin for the S&P 500. That is a high point for the last 30 years or more. Notice Exhibit 5 showing profit-margin data back to 1994.

We expect this to be a major determinant of market direction for at least the first two to three quarters of 2023. Publicly traded companies will more than likely never see these high margins again. Absurdly low interest rates, low inflation and low wage costs all contributed to this high number. It appears that Wall Street has not yet accepted this outcome since they still have extraordinarily high earnings estimates for 2023–24. This makes sense since Wall Street banks need the companies as clients; consequently, they find it hard to speak out. A slow economy will most likely add to profit woes as we go forward.

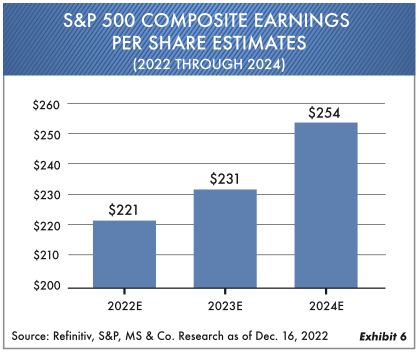

The damaging hook, in our opinion, is going to be that earnings estimates by the consensus on the street will eventually need to be lowered. Notice Exhibit 6 showing the current consensus earnings estimate number for 2023 at $231 per S&P 500 share. What this equates to is that the price-to-earnings multiple is about 17 times future earnings based on the current S&P 500 price, which is still only mid-range but not cheap.

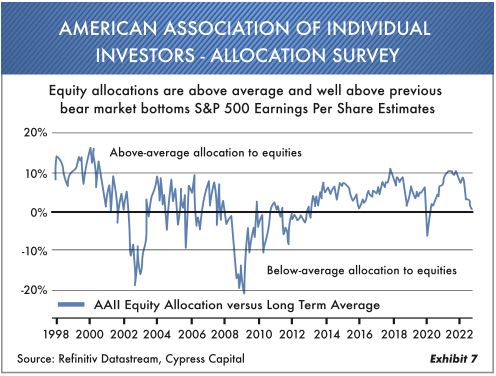

At Oxbow, we expect earnings in 2023 to be something more along the lines of $185–190 per share, which is almost 20 times future earnings and well below street estimates. That translates into lower prices for common stocks for the foreseeable future. The surprise for most people will be the list of companies that have to pre-announce how bad their earnings numbers will be. In our opinion, this means lower stock prices in the first three quarters of 2023. We must add… always keep in mind this produces opportunity in the long run as long as you have liquidity. One of the big things we keep hearing now is how bearish the public is. As you can see in Exhibit 7, most investors still have a high allocation to stocks. Note, the bear markets of 2000–03 and again in 2007–09 produced much more selling.

When we talk to potential new investors that come to us at Oxbow, they repeatedly tell us that they are bearish on the stock market. Then we look at their present portfolio, and invariably it’s at or nearly fully invested in common stocks. It becomes very apparent that their present plan is not working. At Oxbow we think they need another plan that has them less exposed to the market.

The Silver Lining

While the short-term investment environment outlook is not all that great, we’re still hopeful that the long-term outlook improves. What we at Oxbow are doing is keeping enough capital liquid in order to take advantage of potential lower prices. Historically, the first two years after a market low can be quite rewarding. All our strategies did relatively well last year when considering what the average investing account looks like. The main thing we advise is not to get caught up in the day-to-day media hype. Historically, the most negative financial media drama tends to occur when it’s really time to deploy capital. The financial press, unfortunately, will scare you to death at the wrong time!

Also, know that at Oxbow we are watchful to see if there really is a big change coming relative to interest rates and inflation. We strongly feel that government free money and the Federal Reserve monetary policies are mainly responsible for this super-bubble atmosphere. Now as investors you must be responsible for yourself. The Federal Reserve has no room to help you out with lower interest rates. Wall Street is just waiting for the brakes to go on and rates to decline so that they can feel good again.

As we move into 2023, our portfolios are structured much as they have been for the past 12 months—with high liquidity, safety and good cash-flow investments. Rest assured that we at Oxbow will be waiting and watching as the new year unfolds. There could be some real opportunities in 2023, but they are probably farther out. Thanks to all our investors for your trust this past year.

Ted Oakley

Bob Walsh

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable, but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.

GET YOUR COMPLIMENTARY COPY OF TED OAKLEY’S BOOK

Your Money Mentality

Order Below