Fantasy Meets Wall Street

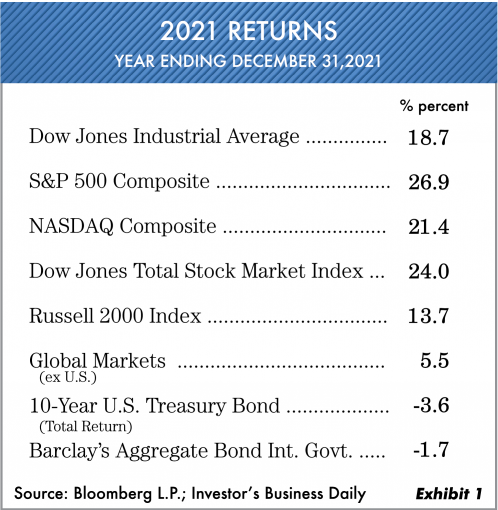

The big news for 2021 was the fantasy world that was created by the surge in new money and the idea that everything is profitable, even if you can’t see it or touch it. The advent of commission-free trading turned the entire market into a modern-day Pac-Man game. The “big three” things that stayed on investors’ minds were inflation, interest rates and COVID-19. (More on that later as we look at the markets for 2022.) When looking at returns, notice that U.S. stocks were well ahead of the rest of the world. Also realize that since April 2021 just five stocks account for 51% of the total return of the S&P 500 Composite. Meanwhile, the markets stayed strong all the way to the end of the year. Exhibit 1 shows the investment returns of various popular market measurements for the year ending December 31, 2021.

Interest Rates and the Bond Market

The year 2021 will likely be the worst year since 1990 for the global bond market. Bloomberg Barclays Global Index was down -4.8% for the year—through December 27, 2021. All U.S. Treasury government bond funds were down as well, and yet most investment advisors keep putting money into funds as if rates were high. With interest rates this low and inflation numbers this high, a huge negative return was created.

Early in the year, investors sold long-term bonds for fear of the economy possibly heating up. Then they sold short-term bonds in the latter part of the year for fear of the Federal Reserve raising rates. Oxbow conservative income accounts weathered the storm really well with positive returns. The reason being is we kept our maturities very short and didn’t join the crowd in buying long-term, low-yielding bonds. Interestingly, it now appears there’s a major change brewing. As the Fed increases short-term rates, the long-term (20–30 years) interest rates are falling. Why is that? We believe that investors are thinking the economy will slow due to less easy money created by the Federal Reserve (Fed).

Inflation: Yes or No?

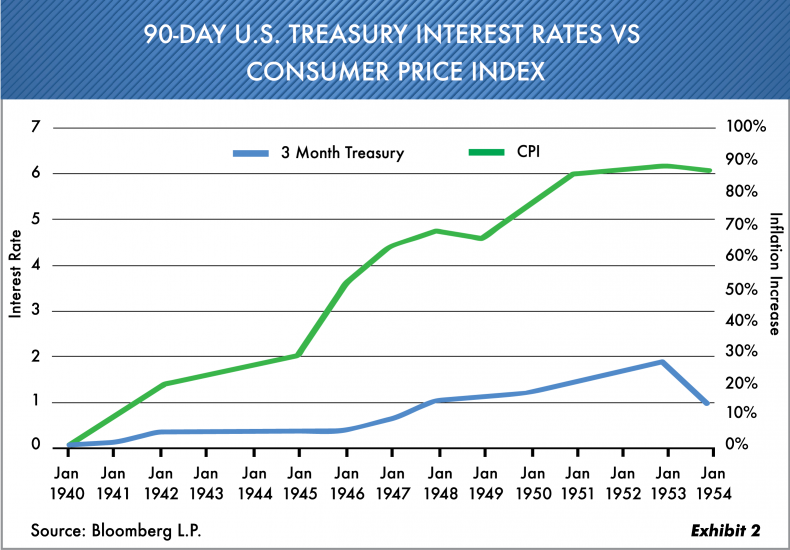

Inflation was obviously a significant issue in 2021. Will it last? That is the question on just about everyone’s mind. In an odd sort of way, we at Oxbow believe that both camps will turn out to be right. Soon higher interest rates will likely occur to combat inflation, and then rates will move lower again as the overall economy slows down. It could be like 1940–54 when the Consumer Price Index skyrocketed. See Exhibit 2.

Interest rates were kept low for that entire period. Notice the 90-day U.S. Treasury averaged less than 1.5% for that entire period. But also notice the Consumer Price Index moved higher all the while. This means buying power decreased substantially during that period as dollars were worthless (though not “worthless”). In essence, it also meant a nice way for the U.S. government to inflate away the debt.

The Only Game in Town

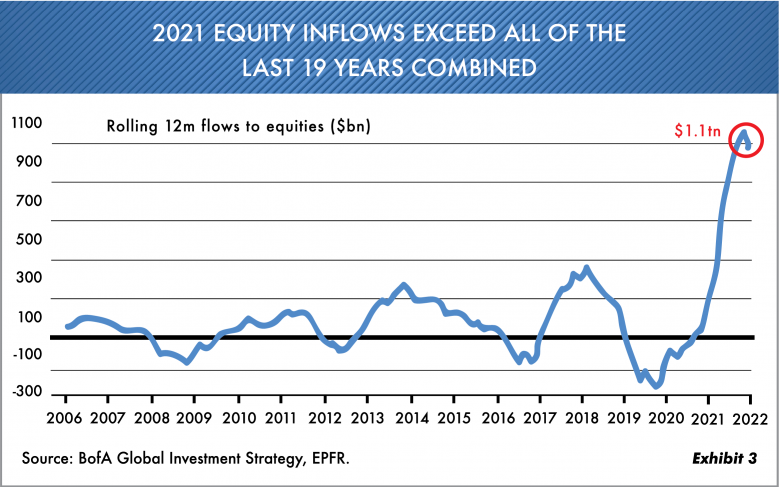

This 12-year bull market has seemingly erased any memory most investors had of slower economic times. The race to not miss out has caused more and more money to get into the markets. High school kids, college kids and older investors are thinking they have found the “Holy Grail.” Exhibit 3 shows the huge amount of money that has come into the stock market during 2021.

Now the rolling 12-month average is over a trillion dollars, which is more than the last 19 years combined! The hubris shown by the average investor is unparalleled, even compared with 1999. According to research firm Cerulli Associates, affluent investors doing self-managed investing for a portion of their investments jumped to 69% in 2021, compared with 35% in 2015. That is what we hear continually at Oxbow … the average Ms. or Mr. X are now full-time traders, spending 2–3 hours a day watching the pot get bigger and bigger.

It all seems so simple, and yet few of these people, or even their advisors, have had to weather a bad market. The Fed has essentially bailed investors out for more than 12 years now. In the Oxbow quarterly Market Update video coming in January, we will remind you of the names that took these same types of investors down the “rabbit hole.” For example, take a look at what happened to the red-hot Munder NetNet Fund in the late ’90s. This reminds us of the old Dire Straits song “Money for Nothing.”

Let’s Borrow Some Money

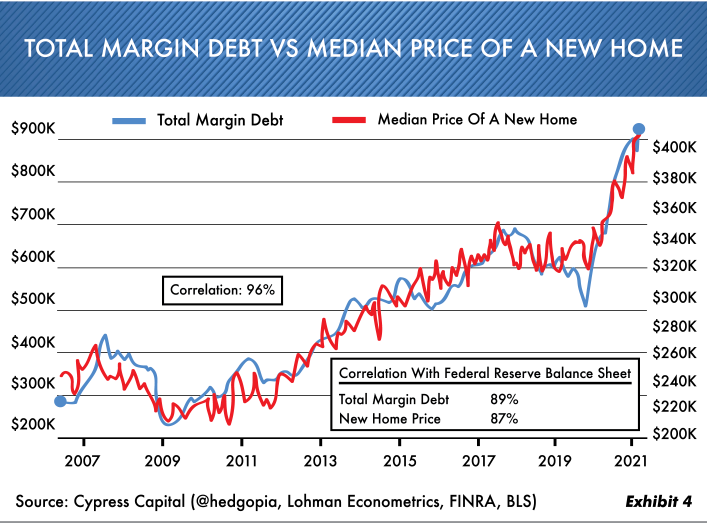

With the Federal Reserve making money readily available at historically low rates, the borrowing has exploded. Not just for stocks but for all asset classes. Notice Exhibit 4 showing the growth of margin debt with the price of a new home. This graph doesn’t include securities-based lines of credit (SBLOC). Wall Street firms have lent billions to people in accounts that are collateralized with stock accounts. They don’t report these numbers, and they’re hard to find, but our guess is they’re almost as big as margin accounts.

Margin debt and home prices are 96% correlated and almost 90% correlated to the Federal Reserve balance sheet. It has all been Fed-induced and artificial. Borrowing is rampant in private equity, real estate, stocks … and now the small investor is in. At Oxbow we have long felt that home prices are affected by the level of stock prices. The real test here will be if and when the Fed actually takes the “punch bowl” away. Borrowing has become so easy that virtually no one really considers any potential problems. The November 2021 announcement by the California Public Retirement System to use borrowed money and more alternative investments is a case in point. Can you imagine leveraging your retirement? This lengthy bull market has erased most fears of anything going wrong.

Fantasy Investing

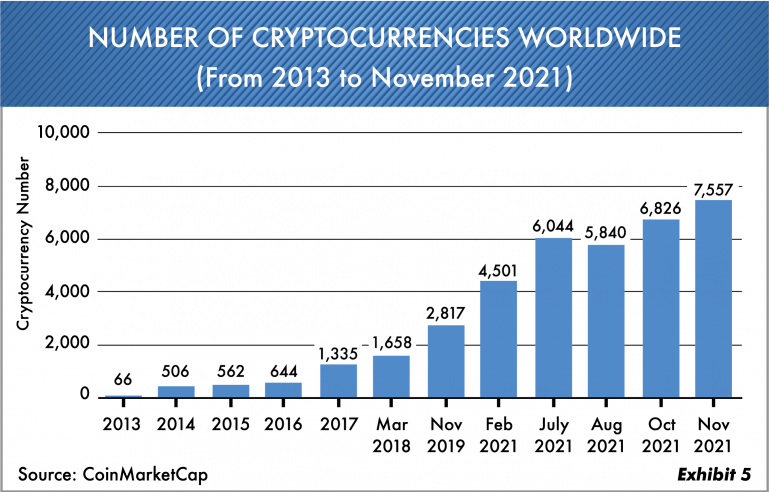

Some say this latest greed is like all previous greedy markets. But we beg to differ. This is more like fantasyland. Who would have thought that regular stock investing would be labeled “old school”? Exhibit 5 shows the proliferation of cryptocurrencies. Do you really believe that most of these digital trades will survive?

With the announcement of no-commission stock trades and the increasing entry of small investors, the stage was set. So, the fascination begins. With all the cryptos and non-fungible tokens trading for enormous amounts, the money is there for the taking—or so it seems. Go look at The Sandbox or NonFungible.com websites for a real eye-opener on speculation. You can buy or sell virtually everything. Fantasyland at its best.

2021 Markets and Beyond

Oxbow’s managed-investment accounts had a good year, especially recognizing we had a cash position all year and still had all three strategies positioned well. In the conservative strategy we were able to stay in front of the poor bond markets. The high-income accounts brought in great returns, beating the overall bond market returns. The growth-stock portfolio also had a good year, and we believe it’s positioned in very good companies. Please keep this in mind when it comes to holding cash.

At Oxbow we understand that cash doesn’t make a lot of money, but cash is the staying power needed when good markets go bad. If cash can keep you as an investor from selling out in a bad market, then it’s a great investment. No one likes to hold cash when prices are going up, and this has never been more evident than today. Behavioral mistakes throughout time have been the biggest problem for investors. This factor causes most investors to lose their sense of reason at both market tops and bottoms. Cash as an insurance policy will create great opportunity when prices decline, but you need to have it to spend it.

As we enter 2022, the new year will likely be different from the past, primarily because there are signs the Federal Reserve will no longer continue to be the backstop it has been. You might keep this in mind because it (the Fed) has been the single, dominating driving force in the market over the past several years.

We want to thank you for being an investor with us. And we wish you the very best throughout the new year.

Ted Oakley

Bob Walsh

“Minds are like parachutes; they function only when they are open.”

–H. Ross Perot

“Creditors have better memories than debtors.”

–Benjamin Franklin

Ted Oakley’s New Book Now Available

Order Below

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.

Please fill out the form below for your complimentary book.

Don’t forget to visit our Books Page for your complimentary print and digital copy of Ted Oakley’s new book Your Money Mentality.

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.