Five Years Ago

How soon investors forget the past! Five years ago, on March 23, 2020, the stock market had just finished an almost -40% decline in just 31 days. Fast forward to August 25, 2020, and the stock market was back to new highs again. Thanks to the Federal Reserve and Congressional money, it was as if the price decline never happened. The problem with that is, it was a continuation of the giveaway money train that had been with us since 2000. In this letter we hope to provide you with some insights into the current state of the markets. For now, returns from various popular market measurements for the first quarter ending March 31, 2025, are shown in Exhibit 1.

End Result of Those Five Years

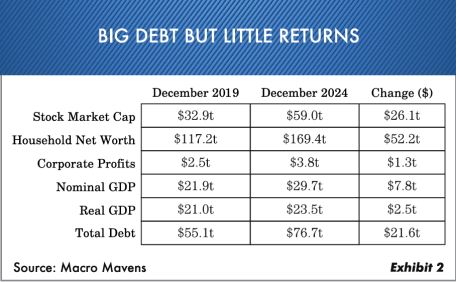

With all the free money that was pumped in during this five-year period, it set off a time period when stocks and real estate were booming. We’ll visit some of those crazy valuations and the ensuing highly concentrated markets. If we take a closer look at what really happened over that five-year span, it will likely shock you. Notice Exhibit 2, which shows what we got for spending almost $22 trillion over that period.

A few things to note here … Corporate profits went up a mere $1.3 trillion, while stock market capitalization increased $26 trillion. Household net worth increased $52 trillion (plus real estate), with assets bid up in a complete frenzy. So, for the $22 trillion in debt, you got very little except a lot of speculation. After inflation, GDP (gross domestic product) in this period increased only $2.5 trillion. How is that for a return on borrowed money? That is where we are today, with government debt at $37 trillion, and there is a lot of work to be done. In 2024 government spending accounted for 24% of GDP. A lot of investors believe this cutback will be short-term pain and over soon. We would caution you on this. When the spending cuts take effect—and if they are carried out—it probably will impact the economy more than expected.

Look at the Big Funds

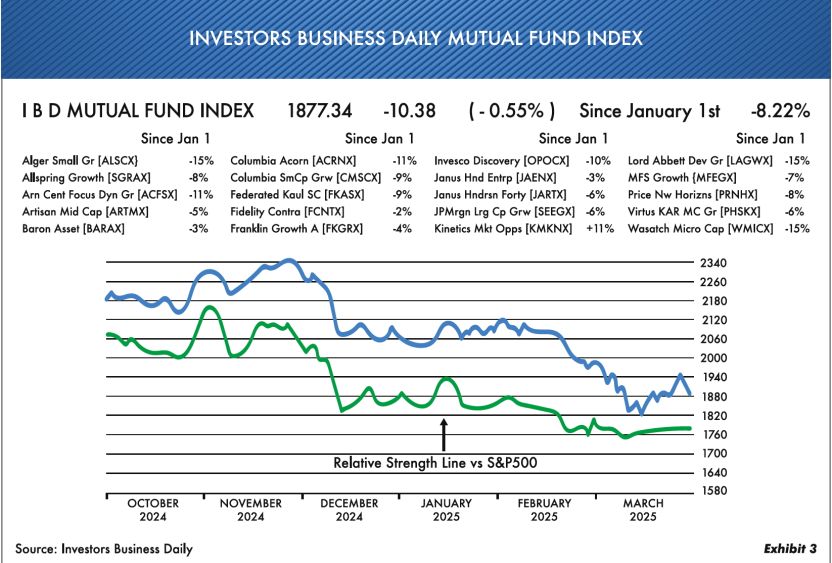

It has been a few years since we have highlighted the Investors Business Daily Mutual Fund Index. It is obviously down for the year as many of those funds you see are hung up in 10 big-cap stocks. Notice Exhibit 3 which shows the index.

Look closely at the returns of the funds in the index as this is a tough time for many. And why not—since they own a lot of the same “Magnificent 7” stocks. As an example, the seven stocks (Apple, Meta, Amazon, Netflix, Tesla, Microsoft and Nvidia) contributed 16% of sales growth and an unbelievable 88% of profits of the S&P 500 over the last three years. Nvidia alone contributed more than 25% of the S&P’s return over that three-year period. Almost all the earnings growth came from just seven big-cap companies.

‘All in’ on Stocks

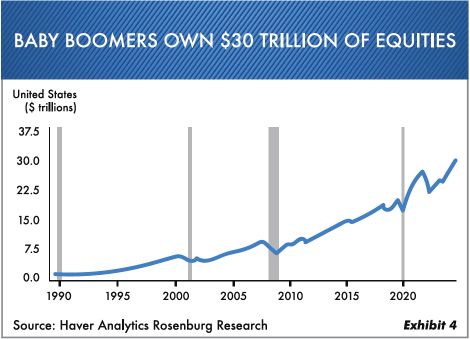

Currently almost everyone—including individuals, endowments, family offices, pension funds and Wall Street—are in the stock market. Record all-time ownership of stocks for family liquid net worth seemingly has hardly anyone worried. Pensions and endowments also have an all-time-high percentage in private equity, a fad that has duped a lot of people into believing this is better than public equity. One of the things we at Oxbow see as disturbing is the amount of money Baby Boomers have in stocks. Notice Exhibit 4, which shows their ownership over the last 35 years.

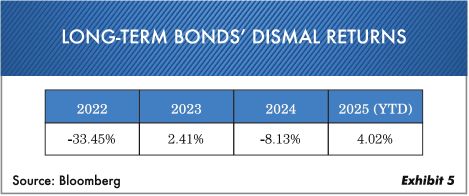

Baby Boomer ownership in stocks has gone from $7.5 trillion in 2012 to $30 trillion today. That’s a 400% increase in 13 years. The average Boomer age is now 70. One has to ask the question: What happens in a real downturn in the stock market? Our belief is that it would not just be an economic problem but also a significant societal problem. Most Boomers have decided the bond market did not treat them well so why not own stocks? Notice Exhibit 5 returns for long-term bonds over the last three years, plus year to date.

For bonds, it has been a disastrous three years ending in 2024. Fortunately, at Oxbow we sidestepped most of that by owning short-term maturities. Our outlook for the next 5–10 years assumes that interest rates generally will be higher. Yes, there will be bouts of weakness but not what the investing bond owners have been accustomed to from 1982 to 2022. We believe that is behind us now. For the foreseeable future, bond holdings should probably be restricted to short-term maturities and traded from time to time. People invested in long-term bond portfolios will have a harder time realizing returns.

Overpriced Relative to the World

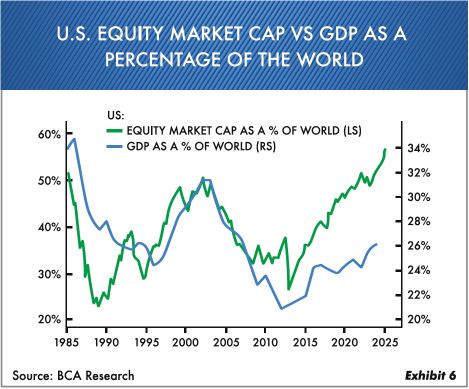

As of the end of February 2025, the U.S. stock market represents approximately 66% of the Morgan Stanley-MSCI All-Country Index, which tracks both developed and emerging markets. It also accounts for some 73% of the MSCI World Index, which captures large and mid-cap representation across 23 developed countries’ market stocks. Just about everyone is “all in” the U.S. stock markets as most investors own the same big-name 10 stocks. Exhibit 6 shows the U.S. equity market cap versus GDP as a percentage of the world.

As shown in the graph, U.S. equity market capitalizations are extremely overpriced relative to what we actually produce of the world’s business. At Oxbow we have added a number of foreign stocks and, in addition, many of our holdings do a substantial amount of business overseas. So far this year we are seeing world markets outperform the U.S. markets.

Going Forward …

This year has already been a topsy-turvy one for the stock market. “Stock picking” has been more important than strictly buying the market averages. Until we see the eventual fallout from tariffs and government cuts, we believe it pays to be defensive. In our opinion, government dislocations will affect the economy more than is presently projected. With valuations historically high, there is little room for error. The Oxbow managed portfolios are well-balanced. Our Conservative Income strategy has done well while keeping maturities short-term. The Oxbow High-income strategy has also had a good quarter—with exposure to commodities, gold, gold miners and energy. All our strategies either have holdings in gold or gold miners or both. The Oxbow Long-term Growth strategy has had a good quarter relative to the popular market averages. We have found undervalued stocks outside the normal heavily owned big-cap stocks of the last few years. There are many factors that can change the investing landscape in 2025.

As always, we will do our best to navigate within a likely volatile 2025 stock market. We wish you a great spring.

Ted Oakley

Bob Walsh

“Show me the incentives, and I’ll show you the behavior.”

–Charlie Munger

“Getting rich is hard. Staying rich is harder. Being satisfied with your riches is hardest.”

–Morgan Housel

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the authors, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.