Let’s Be Careful … Change Is Coming

In our opinion, investors need to realize that change is coming in the market’s investment environment. It likely won’t be the same old mantra of just buy the indexes and forget it. The world is in the 10th year of global expansion, yet most countries are still running fiscal deficits. If that is where we are now, then what happens in the next downturn? More on the subjects of interest rates, bonds, stocks and the outlook for the near future will be discussed in this letter. Exhibit 1 shows various popular market measurements through the first quarter ending March 31, 2022.

Tough Times …

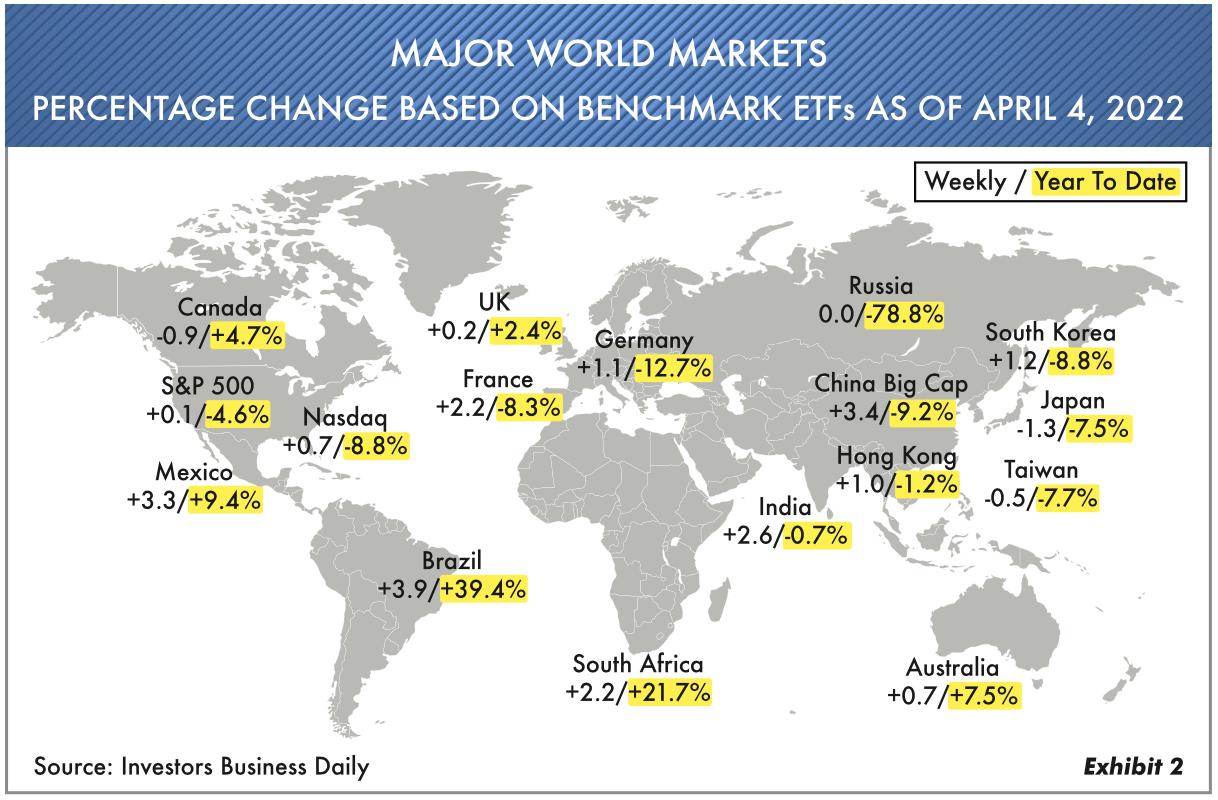

The first quarter of 2022 was a tough one for almost all stock indexes and the bond market. Only gold and oil had gains during the period. The traditional 60% stocks / 40% bonds investment mix had a hard time in this quarter. In our April 2021 Market Comments, you may recall that we stated, “There is no 40%.” We were making the point that bonds would have a hard time due to their extremely low yields. This is exactly what happened, and presently we may be seeing a change in that scenario. Markets worldwide have had a hard time. Notice Exhibit 2 shows Investors Business Daily Major World Market returns this year through April 4, 2022. Only countries like Brazil and South Africa had positive returns due to favorable commodity prices.

Most noteworthy is the overwhelming -78% decline in Russia, as well as European countries being under pressure (Germany, France and the United Kingdom). The point here is that there have been few places to hide other than cash.

Consumers Not Upbeat …

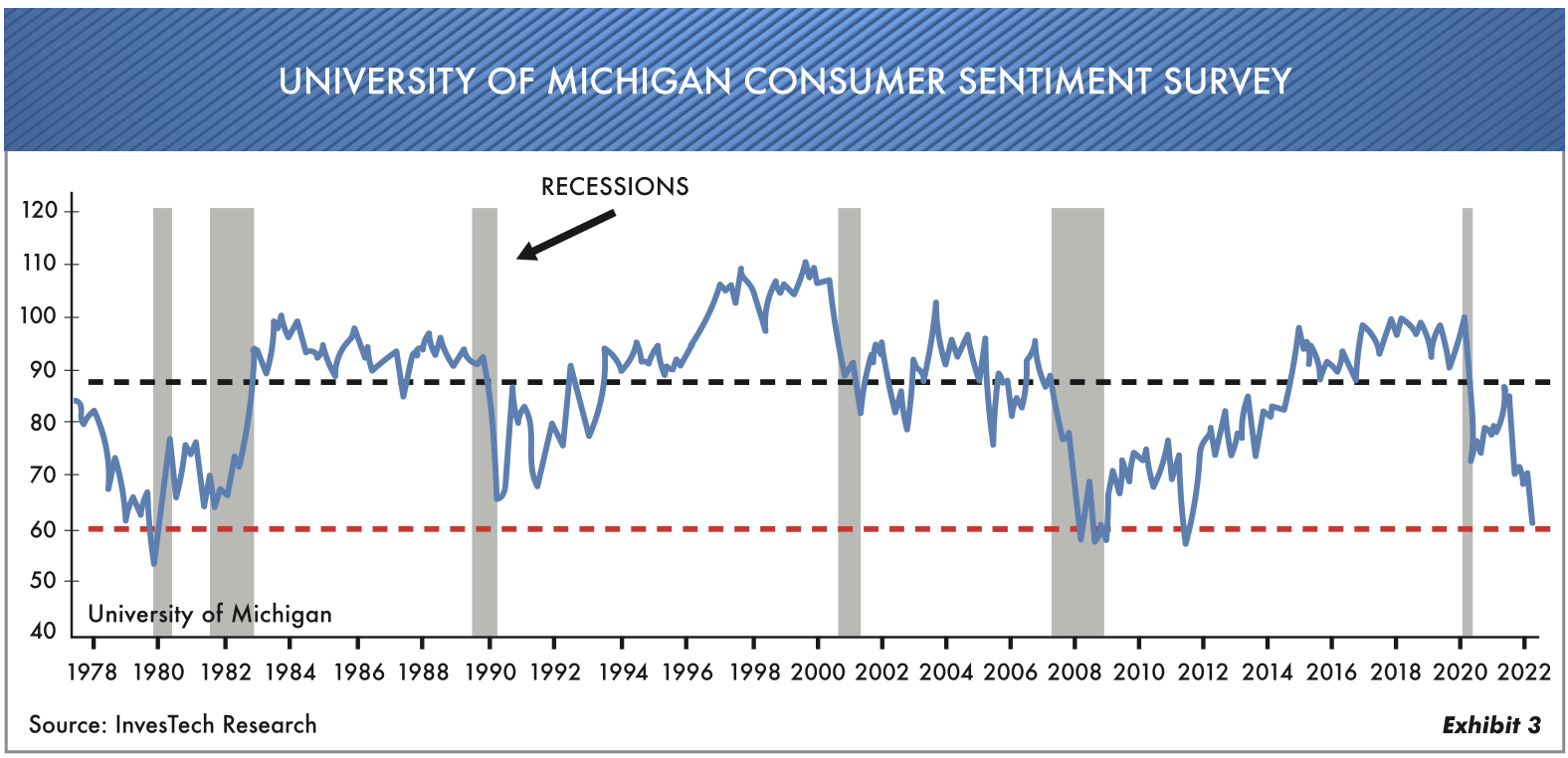

The latest long-term University of Michigan Consumer Sentiment Survey is downbeat to say the least. Exhibit 3 shows overall consumer sentiment plunged to a level even below its 2020 reading.

Why shouldn’t the consumer be downbeat? Seventy percent of the U.S. economy is the consumer, and most people in this category have little or no savings. With gasoline prices currently up at least a dollar or more a gallon, food costs up 35–40% and sky-high rents, the consumer is getting squeezed.

From a CNBC Lending Tree report of March 8, 2022, we find some interesting facts. Presently 64% of families in the U.S. are living paycheck to paycheck, which is up from 62% in January 2022. Two years ago 65% of families also were living paycheck to paycheck. What this means is that we are not much better off today than during the depths of the Covid problem. Inflation hurts this group more than any other, as wages are simply not keeping up. Why would most of the Wall Street talking heads think this year is going to be great? There is little room for extra spending, with belt tightening increasing in the real world.

In the past, grandparents called this the “light bill,” which was their code for the “electric bill.” These families that are barely paying the light and water bills will have to cut back on discretionary spending. Therein is our expectation: At least one calendar quarter this year the U.S. will either be in a recession or close to it.

Fed to the Rescue …

Since 2009 investors have gotten accustomed to the Federal Reserve making sure everything goes well in the economy and the stock market—and that interest rates remain low. The biggest reason for the incredible asset price increase can be traced back to the low interest-rate environment. Investors may be surprised this time around that the Federal Reserve can’t help them! With almost 8% inflation, and midterm elections coming up soon, the Fed is under pressure to get inflation down, i.e., there are 40% of the people out there voting that are getting beat up financially. So here we go.

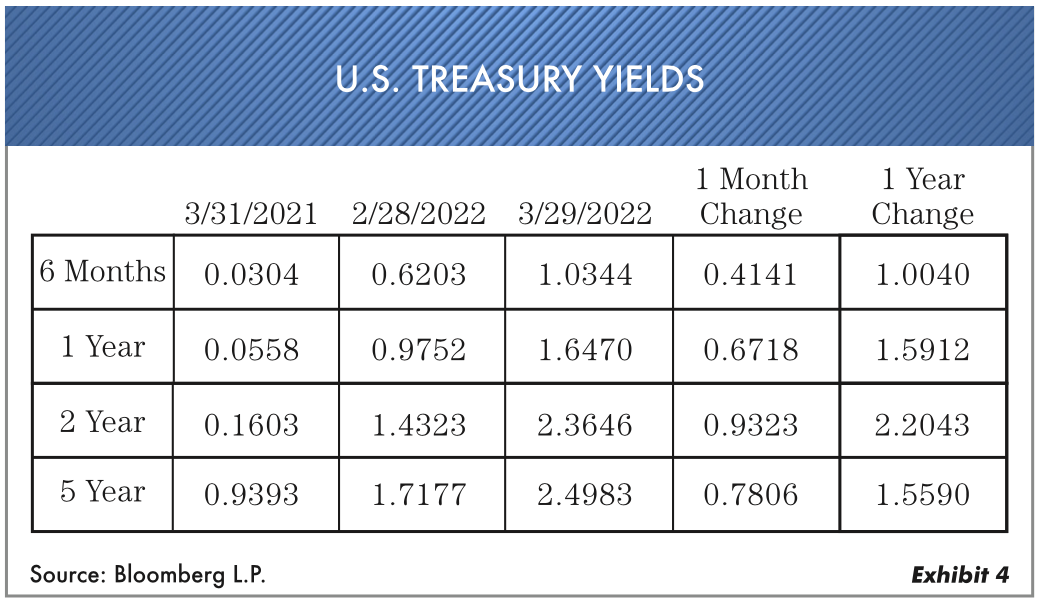

Up, Up and Away …

Exhibit 4 shows the incredible increase in short-term interest rates in March, as well as the past year. The two-year U.S. Treasury yield has had a 3 standard deviation move in just 30 days. That has happened possibly only one other time during the last few decades.

Crypto Not So Great …

CNBC recently published its semiannual “Millionaire Survey.” More than half the millennial millionaires surveyed have at least half their net worth in cryptocurrencies, and almost a third have at least three-quarters of their wealth in crypto. They may want to remember this Warren Buffett quote: “The core use case for bitcoin is to sell it to someone else.” Can you imagine how many of these investors feel now that the majority of crypto coins are seeing major losses? Here’s a small exercise to show you the price weakness in most coins.

-

Go to the website https://coinmarketcap.com

-

Click on the chart on the right-hand side of any name. Then click the 1-year chart.

-

Notice the losses for most of these from the September–November 2021 high.

The number of losses since October 2021 is huge. With over 9,800 of these coins, it’s hard to see a positive outcome in general. For all these newbies who think the holy grail is in cryptos, we at Oxbow see major losses ahead for them, unfortunately. By the way, we have heard it all: new paradigm, boomers lost it, the wave of the future. The bottom line? There is no free lunch.

In the end, we’re quite certain that the technology and certain coins will survive. But we haven’t even seen regulation yet—no 1099s and governments intent on getting their piece. This group of newfound wealth is looking at “anything but great cash flow investments.” A Wall Street Journal article showing households investing more than $500,000 and headed by an under 45-year-old person notes that 70% of them were mostly self-directed. As a group, these individuals probably have more risk than anyone now. As we said in our July 2021 Market Comments … “What, Me Worry?”

Current Strategy …

As most of our readers know, we at Oxbow came into 2022 with a high percentage of cash-equivalent liquidity and have since increased that amount. The main point here is to know a change when you see it. We call it “the 40-year run”: 40 years of declining interest rates, 40 years of reduced corporate taxes, 40 years of profit-margin increases, with inflation going down all the while.

Unfortunately, there is currently an entire group of financial advisors who have never seen a full commodity cycle or a long-term trend of rising interest rates. This condition is similar to what is occurring in the real-estate business. Most of the outlandish prices are being paid to older investors by younger investors.

There comes a time in all investing when we need to slow down and really assess what we own. As Bill Ruane, founder of the Sequoia Fund has said, “Doing nothing is underrated in investing. Swing only when the odds are favorable.” At Oxbow we feel like we’re well-balanced with income, safety and growth. Chance Finucane, Oxbow’s chief investment officer, has done a great job getting the growth portfolios in a safer mode. In the high-income and conservative accounts, we have done the same.

In this environment you as an investor have to make sure your investments are in an overall position to be able to maneuver any type of market. Having said that, we see market turmoil as an opportunity to own investments at great valuations. Most of our best years have come off of market lows. Why? Because we have liquidity to use.

Here’s hoping the spring and summer are good for you—and we get back to more normal times. It feels better just to be able to do the things we got used to doing before Covid showed up. Let’s be thankful for that. All the best to everyone.

Ted Oakley

Bob Walsh

“You’re unlikely to succeed for long if you haven’t dealt explicitly with risk.”

–Howard Marks

“Federal Reserve forecasts for interest rates have been correct only 37% of the time since 2012.”

–Rosenberg Research

Ted Oakley’s New Book Now Available

Order Below

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.

Please fill out the form below for your complimentary book.

Don’t forget to visit our Books Page for your complimentary print and digital copy of Ted Oakley’s new book Your Money Mentality.

Your Money Mentality

Ted Oakley’s new book Your Money Mentality explains how investing is not linear and that successful investing sometimes goes against conventional wisdom. From Oakley’s years of experience, he walks investors through the highs and lows of the market to help them determine their own money mentality.