It’s a Different Time Now

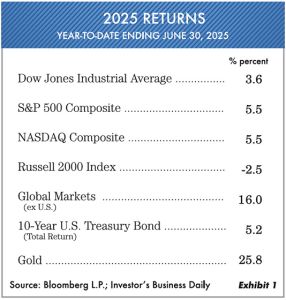

In this edition of Market Comments we’ll discuss why the investing landscape is very different from any time in the last 15 years that investors have become accustomed to. There are now factors that the country is up against that have not previously existed at this level. In this issue we will attempt to cover most of the key factors. Notice that Exhibit 1 shows the investment returns for various popular market measurements for the first six months of this year ending June 30, 2025.

Consider the Setup …

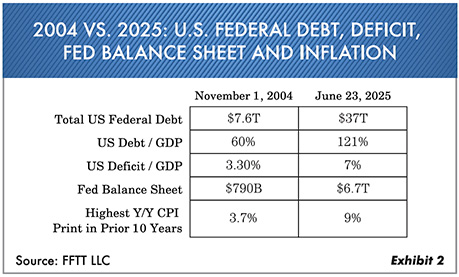

Your normal reaction will likely be: “Oh yes, that’s been said for a while, so what’s new?” The long-term money printing by the Federal Reserve and Congress is just about to hit the wall! There comes a point where foreign buyers say no thanks to buying U.S. bonds. This has been happening for a number of years. The U.S. public investor has picked up the slack, but that can change quickly. Notice Exhibit 2 shows major differences the last 20 years.

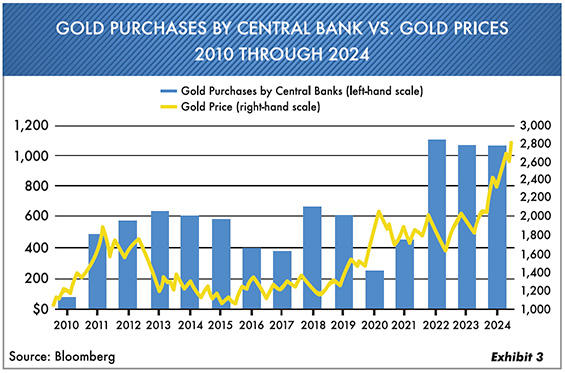

All these numbers have skyrocketed to the point where the U.S. Treasury finally realizes they have to do something. Either loosen restraints on banks so they buy more debt or come up with another trick or two. The U.S. public also has been a buyer, but foreign central banks are not increasing their buying. When the world loses faith in the dollar and the U.S. debt, they turn to other things. Notice Exhibit 3 showing gold purchases by central banks and the price of gold.

How Does This Affect Bonds?

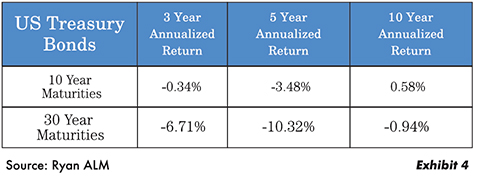

If you owned 10-year or 30-year U.S. Treasury bonds the last 10 years, you lost money in five out of six periods—and yet, Wall Street has pushed investors into owning these bonds and continues to do so in the form of bond funds. If the U.S. continually runs deficits (and we think they will) the debt ceiling goes higher and higher, i.e., continues to do the same old thing over and over. But if stock markets decline or the economy is weak, they have bouts where interest rates go down for a period of time. Look at Exhibit 4 showing returns for those two bonds.

If the economy is weak, in our opinion, the Federal Reserve lowers interest rates. If the stock market direction moves lower, then the Federal Reserve will likely lower interest rates. When that happens, bond yields will fall, and bond prices will rise. We at Oxbow believe this could happen in the short run (3–4 months). If that happens investors should sell their long-term bonds. With more debt and rising deficits, it’s just a matter of time until inflation rises again. Holding long-term bonds or bond funds for extended periods, in our view, is a mistake. We think this may be your chance to unload long-term bonds for some time. And, by all means, don’t chase yields by going longer in maturity—because that’s what got this going in the first place!

Which Brings Us to Stocks …

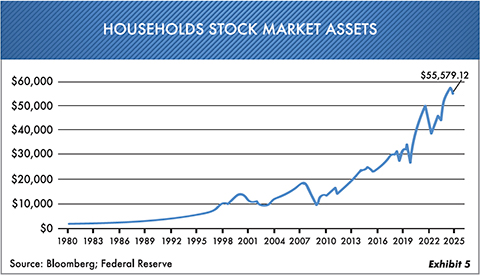

Currently, the effects of tariffs have not fully taken hold. With supply chains interrupted, this could factor into rising stock prices. As of this writing the market rise since “Liberation Day” April 7th has only caused investors to believe even more that markets can’t go down. If it does occur, it will be only for a short time. The stock market hasn’t yielded good returns year-to-date, but investors believe differently. They’re back to chasing the same big names. They’ve added a record $437 billion into U.S. ETFs (exchange-traded funds) this year. The majority of investors believe they can’t lose, so they buy during every dip. Notice Exhibit 5 showing U.S. households have $55 trillion of stock exposure. This is the highest ever on record.

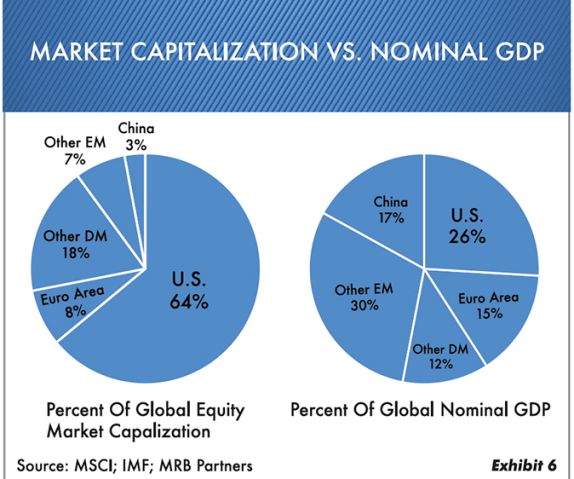

In addition to markets being priced to perfection, nearly everyone is all in. Examples are 401(k) balances, investors ages 50–80 have the greatest exposure to stocks of all groups. Meanwhile, most older investors are not seeing the danger of their assets exposed to a precipitous fall. Between the equity in their homes and the market they are spending like crazy. There will be more on those topics in our quarterly portfolio call. In short, now the whole world is in the U.S. stock market. Notice Exhibit 6 showing the percentage of world investments that own a major portion of U.S. stocks.

The problem is this: All world investors are invested in the U.S. market at a 64% level. But the U.S. makes up just 26% of world GDP (gross domestic product). This is a complete mismatch. With a combination of investor complacency, trade wars, outlandish government spending, leverage, speculation, deficits, debts and loss of faith in the U.S., it can get toxic.

What to Do Now?

Our advice has been to keep a reserve of liquidity because it will pay off when stock prices do correct. The reason we say It’s a different time now is because the headwinds are many. At Oxbow we have added more energy and commodity exposure. In our stock accounts we have names such as Otis Elevator, Yum, Roche, Chevron and Conoco Phillips. However, our total outlook remains the same. It appears that the next decade will be a trading decade. In our opinion, you will need to take advantage of lower prices and let go of some current high-price holdings. One of our proprietary indicators which measures overall market direction is flashing yellow or caution.

Our approach so far this year is working. We will be diligently watching upcoming events for any changes. We wish everyone a great summer.

Ted Oakley

Bob Walsh

George Washington Farewell Address: September 17, 1796

“However [political parties] may now and then answer popular ends, they are likely in the course of time and things, to become potent engines, by which cunning, ambitious, and unprincipled men will be enabled to subvert the power of the people and to usurp for themselves the reins of government, destroying afterwards the very engines which have lifted them to unjust dominion.”

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the authors, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.

Ted Oakley’s Complimentary Book Available

Second Generation Wealth

Order Below

Second Generation Wealth identifies the best practices for properly preparing your children to inherit wealth, manage it responsibly while maintaining their self-worth, and foster a promising family legacy.

Please fill out the form below for your complimentary book.

Ted Oakley’s Complimentary Book Available

Second Generation Wealth

Order Below

Second Generation Wealth identifies the best practices for properly preparing your children to inherit wealth, manage it responsibly while maintaining their self-worth, and foster a promising family legacy.