The Coming Changes

This year has brought many changes that are having varying effects on investing: economic measures, Federal Reserve policy and unsettled international conditions. In this paper we will be concentrating on potential additional new changes that we think may soon occur.

Most investors currently are sitting happily without major worries. It reminds us of the song written by Milton Ager in 1929, “Happy Days Are Here Again.” President Franklin Roosevelt then used this phrase as his campaign song in 1932. Ironically, history shows that this theme had to wait a while before it worked. Today many of the likely new changes will bring both opportunity and pitfalls. Exhibit 1 shows the investment returns of various popular market measurements for the first nine months ending September 30, 2024.

Change … the Road Ahead

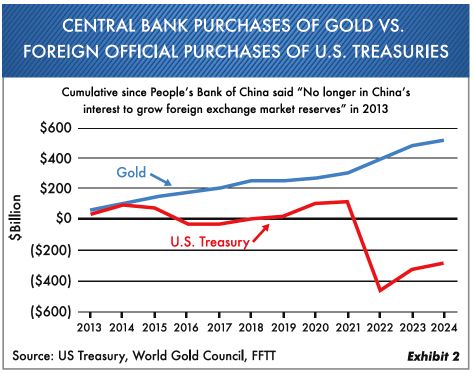

The biggest headache for the Federal Reserve and the U.S. government has been – and continues to be – the large and growing national debt. Sad to say, going forward the annual, rising U.S. debt service will be more expensive than total spending on national defense. The principal problem with this is that few foreign investors are buying U.S. bonds anymore … change. Most of them would rather purchase gold and trade in other currencies other than the dollar. This has been going on since early 2013, as seen in Exhibit 2.

If the U.S. government continues to run $2 trillion deficits in good times, imagine what it will look like in bad times. (To us at Oxbow this means keeping our bond maturities short-term, less than two years.) While we do own a small percentage in longer maturities, they will be traded. If you followed us over the last two years, we have said this decade is one where bonds will need to be traded. While there may be a period where the Federal Reserve pushes rates down, in the end inflation may well rear its head again. We believe that this is when the Fed will make an error. Stagflation much like the 1970s will probably reappear. The Federal Reserve (academics) are likely to be frustrated.

Another Change: Commodities

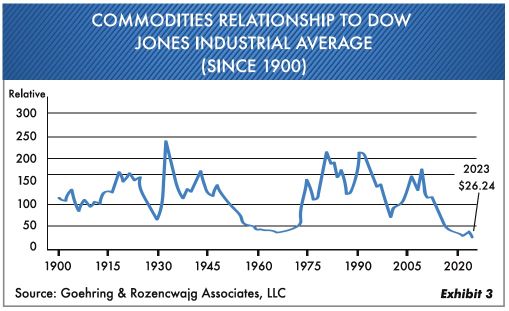

At Oxbow we have said for some time that the change people don’t expect is the reemergence of the commodity cycle. The tables have turned, with so many countries now having more materials for sale than the United States does. Notice Exhibit 3 showing the Dow Jones Industrial Average compared to commodities for the last 125 years.

Relative to the Dow Jones Industrial Average, commodities have not been this cheap in almost 125 years! (That is something to think about if you’re even a little contrarian.) This is another reason why Oxbow portfolios have holdings in oil, gold, gold miners, fertilizer and silver. Hard assets will likely be an area to seriously consider in the next few years. That is another change … Investors on the whole are very underweighted in commodities. Their financial advisors in general haven’t seen this environment before.

Then There Was Gold …

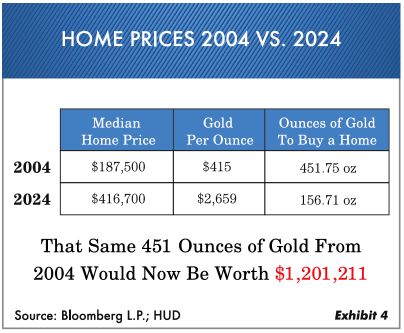

Gold is changing, as it has been an almost forgotten asset for a number of years but has finally started to shine again. Today most foreign governments want to own gold instead of the dollar. They realize that with the currently high U.S. debt load, the dollar declines. Most people misunderstand gold as an investment. The old thinking, “If gold isn’t paying dividends, then what is its value?” still exists. We at Oxbow feel gold is misunderstood. It isn’t meant to be like stocks or bonds. For example, see the illustration in Exhibit 4 showing how gold relates to home prices.

Twenty years ago it took 451 ounces of gold to buy the average U.S. home. Now the same average home can be bought with 156 ounces of gold. The original 451 ounces of gold are now worth $1,201,211, almost three times the cost of that average home. If you own gold, whatever percentage, it’s meant to be held as a long-term hedge.

The Nvidia of the 1920s

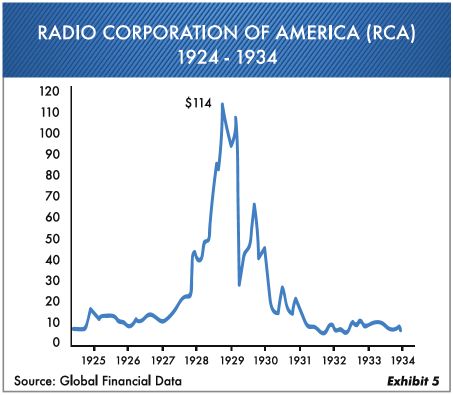

The most talked-about stock over the past year or so is on everyone’s list and in nearly everyone’s portfolio: Nvidia. Historically, every bull market has a stock that tends to take over the market. In the past it was Polaroid, Cisco Systems and, yes, RCA.

Radio Corporation of America (RCA) was the hot stock of the late 1920s as shown in Exhibit 5. Back in those years RCA had just introduced a new product – the radio. The thought was that this new product was going to change the world just like the Internet and AI (artificial intelligence) are presently doing. At that time, RCA caused Americans to gather around in a circle in their homes and listen to news and entertainment. Then, one of the greatest joys of modern life was listening to the radio! Even the U.S. government is reported to have said that every farmer should have a radio. This view prevailed until competition came along to also start making and selling radios. RCA stock (like Nvidia) went from $1.15 to $114.00 and then back to $2.50 in 1932. (This price remained low into 1940.) The lesson: Be careful with these all-or-nothing stocks.

With historical hindsight the same could be said of Polaroid-maker of the instant camera. It was extremely popular in the late 1960s and a “darling on Wall Street” as it’s price soared to $120.00 only to lose 80% of its value by 1985. Subsequently it went out of business in December of 2003 at a price of under $1.00 per share. Cisco Systems (CSCO) is another example of what happens to an extremely popular stock. After reaching a high of $82.00 in the first quarter of 2000 CSCO fell 89% to a low of $9.00 in early October 2002, even underperforming that bear market. Today it’s still underperforming the overall stock market… Virtually every bull market at one time has some of these very high-priced stocks.

Money, Money, Money …

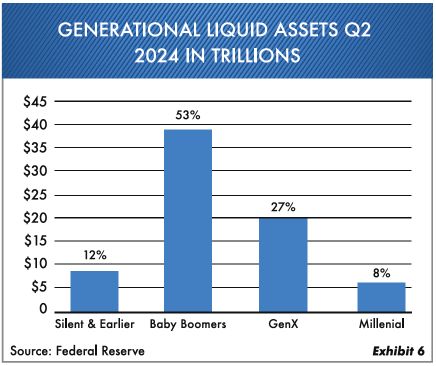

Where is all the money coming from? When you look at hotels, national parks and airports, the bulk of the spending is coming from Baby Boomers. Most of their portfolios are up, home ownership has dramatically increased, prices in home real estate are up, and many of them look at things like “You only live once.” Maybe they have just 10-15 years to live healthy, so “Let’s go out and spend it.” Notice Exhibit 6 showing how Boomers own by far the majority of liquid assets.

In short, we have attempted to show some potential changes. In 2024 our Oxbow managed portfolios have added numerous names, which differ from the past. In our stock portfolio Entergy, GSK, Coca-Cola, Conoco, Diamondback Energy and Evergy. In our high-income accounts, we added names like Nutrien, Mosaic, Silver and Healthpeak. In our opinion, the present market environment appears to be very unstable. As a result, the overall stock market is likely to witness increased volatility between now and the end of this year. Consequently, many existing and new changes, which we discussed above, could factor into stock prices. At Oxbow we have been initiating new buying positions that appear to be undervalued.

Currently a record 42% of household financial assets are now invested in the stock market. That is twice as high as 2009, 2000 and 1968 … all major market tops. It’s best to try not to second-guess yourself if you’re skeptical or cautious about these markets. We think you should be careful, as you can see by our continued high cash reserves. Numerous things will likely change between now and our next Market Comments letter.

We wish you the best for this autumn and the upcoming holiday season.

Ted Oakley

Bob Walsh

“In politics, an absurdity is not a handicap.”

-Napolean Bonaparte

“Remember that happiness is a decision, not a result”

-Dan Sullivan

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the authors, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.