What You See Is Not What You Get

As we enter the mid-year point of 2024, we don’t recall a time when the average investor was more befuddled and confused. The idea that everyone can own the same thing (five stocks), and all will be happy in the long run is not a very good business plan. In this letter we’ll give examples of why this is not realistic, plus discuss the current state of the stock and bond markets. Exhibit 1 shows the investment returns of various popular market measurements for the first six months of 2024.

Does anything look odd to you in the exhibit above? Notice how the returns of the 10-Year U.S. Treasury Bond, the Dow Jones Industrial Average, and the Russell 2000 Index compare to the S&P 500 Composite. Obviously, there is a huge difference because of the very few names in the S&P 500 Composite that are responsible for 60% of that measurement’s move. They are Nvidia, Microsoft, Meta, Google and Amazon. Later in the letter we will explore this in more detail, but first let’s look at the present economic signs.

The Consumer Is Fine … Headlines

Here are two headlines that appeared recently in Forbes and Wells Fargo publications.

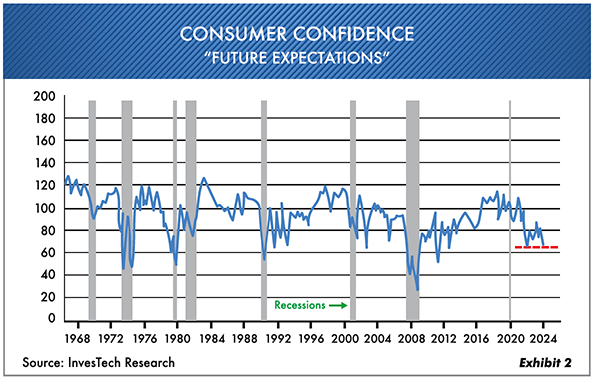

Most of Wall Street is saying there may be slight weakness in consumer spending, but very little, since the bulk of their purchases have been concentrated in services and not goods. Any change in services, and it’s a different story. Notice Exhibit 2 showing the downtrend in consumer sentiment that began in 1999. It is currently one of the worst in 50 years. Increasing credit-card defaults, increasing auto-loan defaults and soaring food prices have consumers in a bind. We at Oxbow Advisors believe that the consumer is not nearly as well off as one is led to believe. What you see is not what is really happening.

Residential Real Estate

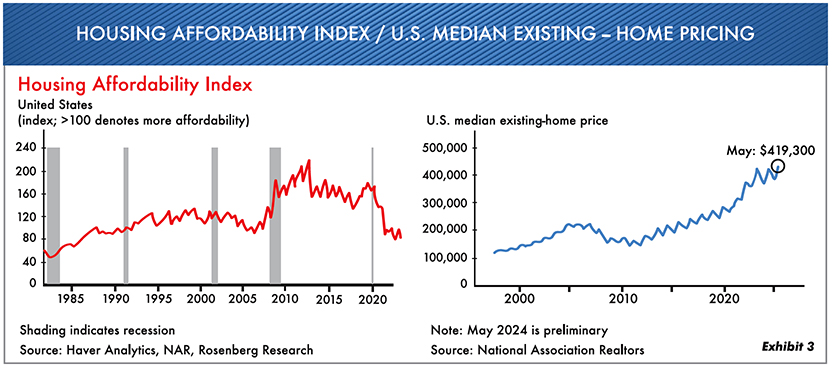

What you have been told about the residential real-estate market is that, as soon as mortgage rates start to come down, it is business as usual. At Oxbow we have said for some time it is really price, taxes and insurance that matter. States like Florida, Texas and Arizona are experiencing slowdowns. Listings are up, and sales are down. As one of our investors in the business tells us … you can sell only a diamond or a deal. In Exhibit 3 the two charts show the affordability index at lows and the median price at all-time highs.

Stay Away from Those Bonds …

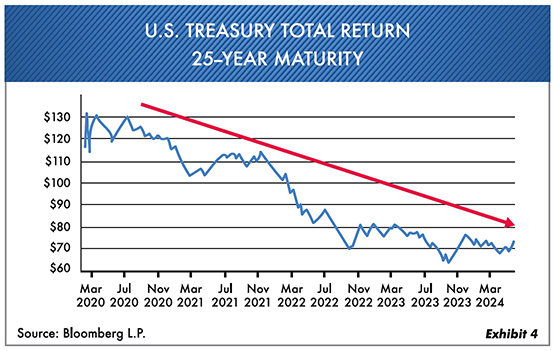

The stock market has been the only game in town, and this has caused investors to retreat from U.S. Treasury bonds other than very short-term maturities … and why not? Since March 2020 the returns (plus the interest) for the U.S. Treasury issues have been dismal. See Exhibit 4, which shows the negative return of -30% for 25-year maturities since 2020—and that includes interest. In reality, many investors have fled from U.S. Treasury bonds for more junk bonds and high-yield alternatives.

What you see is probably not what you may earn in fixed income over the next 12 months and beyond. For that reason, at Oxbow we have moved some of our maturities out to 2–5 years. A slowing economy and shaky world situation leads us to believe that interest rates could start to shift lower. If they don’t, we have a lot of very short-term bonds to absorb any change.

The Stock Market Has Been Great

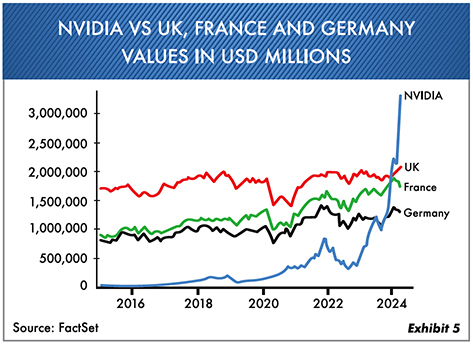

Oh really, which one? The stock market is the best example of “What you see is not what you get.” First of all, the S&P 500 Composite is up nicely for the year. However, the average stock is only about even with early 2022. One stock, Nvidia, has made up one-third of the return this year and 44% of the gains since early 2022. Notice Exhibit 5 showing the current remarkable capitalization value of Nvidia versus the individual market capitalization of the United Kingdom, France or Germany.

When the stock of one company is the dominant concentration of the index funds and exchange-traded funds, it does not bode well for the future. One has to let that sink in a little: One stock is worth more than any of those entire stock markets. This bubble market has disguised and tended to conceal faltering retail sales and tough residential real-estate realities.

Just About Everyone Is All In

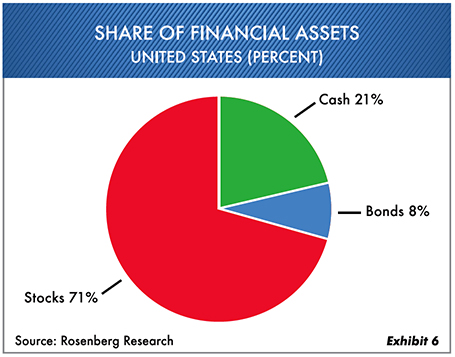

Presently market statistics show that most of the public is all in regarding this stock market, regardless of investor age. The stock market has become a national pastime. The janitor in my building, high school kids, and 80-year-olds are all talking about the market … and mainly Nvidia. We hear this firsthand all the time. The percentage—at over 50%—of households in the market with stock allocation is the highest since 2000 and 1968. Remember, in 1929 only 10% of households were invested. The stock market is becoming America’s favorite hobby. As shown in Exhibit 6, the shares of all financial assets are 71% in stocks and only 8% in bonds.

Here’s the problem … Investors are piling into indexes and exchange-traded funds. These indices (primarily S&P 500 Composite) are top-heavy with only 3–5 stocks carrying the bulk of the performance. Everything is about price, not value. In this way, investors are not really diversifying at all. The downside is when people decide to be sellers rather than buyers and the indexes decline more than the average stock.

A very large number of 401(k) money and stock-allocation strategies are presently recommending index investing. In many respects, they are buying just a few stocks. In our opinion, the market now is at least 25% overvalued. And you say, “I’ve heard that before.” Our job at Oxbow is to preserve your hard-earned capital. We do this by not fully participating in these peak greed markets. It is most important to preserve capital, create good cash flows and own other things besides the index. In other words, truly diversify. Too many people over the ages of 60, 70 and 80 are currently overly exposed to stocks. This will be a problem for society when the stock market turns down. If we are wrong and the markets never sell off (historically this has never happened), Oxbow investors should still make money. But if we are right and prices eventually come down, then the liquidity side of your portfolio will be truly valuable.

Having said all that, there are still things to own that are attractive. In our conservative strategy we continue to buy floating-rate Treasuries yielding 5.3%, 1- to 2-year U.S. Treasury issues and numerous tax-free bonds due in 2026. In our high-income strategy, we keep buying MPLX Limited Partners (8% yield), Enterprise Products (7.1% yield) and the Allstate 5-year bond at 5.05%. Our long-term growth stock accounts have added Roche Holding (4% yield), Entergy (4.3% yield), ExxonMobil (3.3% yield) and Coca-Cola (3.0% yield). Good investors need to understand what they own. At Oxbow we think we do know what we own.

Our next Market Comments will be in early October 2024, and many things can happen between now and then. Elections, Mideast conflicts, Russia-Ukraine, China-Taiwan and other potential problems are all things that could create heavy market volatility. For example, all over the world more than 80 elections remain this year alone, and it appears that most people everywhere are anxious about the future.

At Oxbow we will continue to keep your interests uppermost in our minds. We wish all of you a great summer!

Ted Oakley

Bob Walsh

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the authors, may differ from the views or opinions expressed by other areas of the firm and are only for general informational purposes as of the date indicated. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee as to its accuracy or completeness. This material is not intended to be relied upon as specific legal or tax advice or investment recommendations for any individual as the information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person.